Importing a car into Kenya is more than just shipping – it involves strict rules, taxes, and paperwork. Here’s a quick rundown of what you need to know:

- Vehicle Eligibility: Must be right-hand drive and less than 8 years old. For 2026, only vehicles registered in 2019 or later qualify.

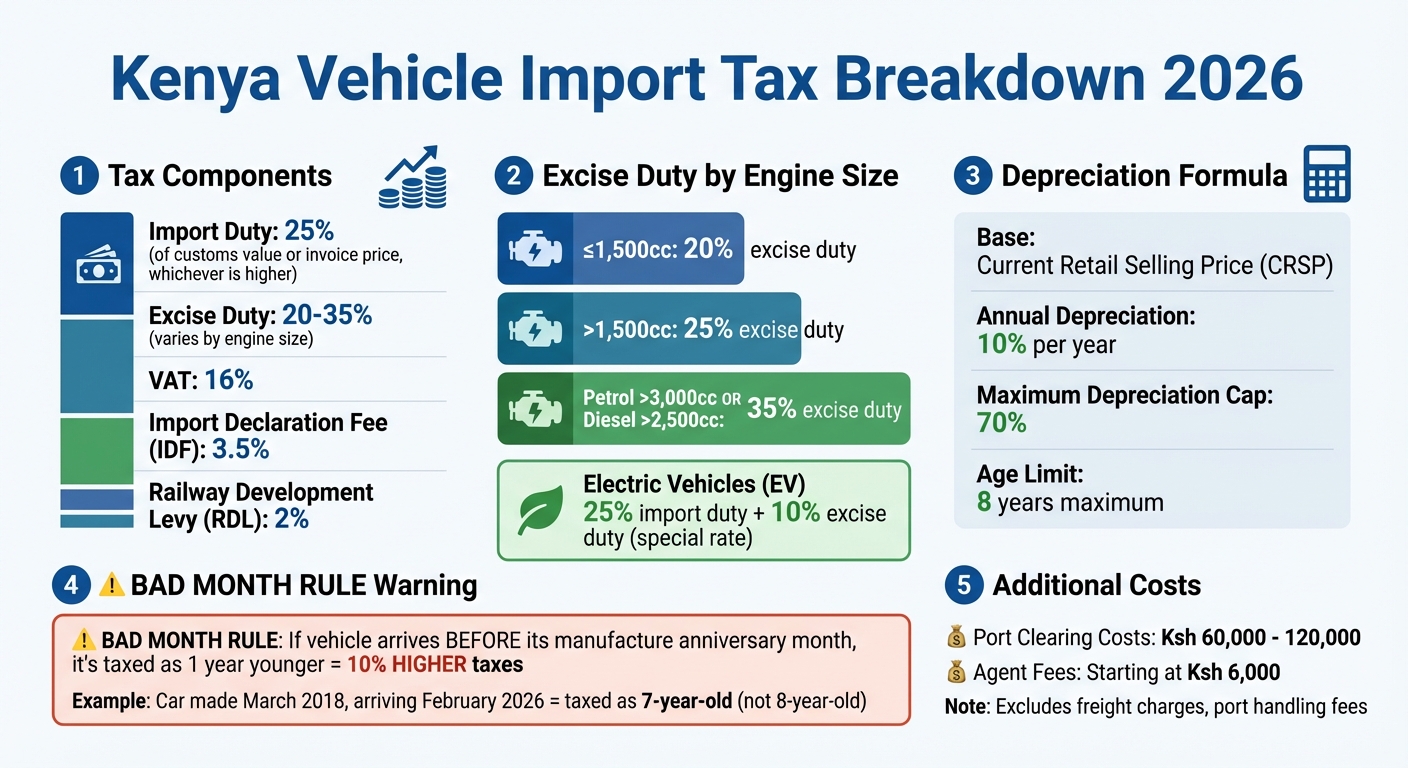

- Taxes and Fees: Expect to pay 25% import duty, 20–35% excise duty (based on engine size), 16% VAT, 3.5% Import Declaration Fee, and 2% Railway Development Levy. Clearing fees range from KSh 60,000–120,000.

- Certificate of Roadworthiness (CoR): Required from a KEBS-approved inspection agency before shipping.

- Documentation: Original logbook, Bill of Lading, Commercial Invoice, and Import Declaration Form are mandatory.

- Emission and Safety Compliance: Vehicles must meet Kenya’s standards, including pre-shipment inspections for emissions and safety.

- Shipping Options: Choose between Roll-on/Roll-off (RoRo), container shipping, or air freight. Shipping from Japan takes 4–8 weeks.

- Customs Clearance: Must use a KRA-licensed clearing agent and pay all duties before release.

- NTSA Registration: After customs, register the vehicle with NTSA via the eCitizen portal. Provide all required documents and pay applicable fees.

Key Tip: Double-check your vehicle’s age, inspection documents, and shipping timeline to avoid costly delays or rejections.

Kenya Car Import Tax Breakdown and Cost Calculator Guide 2026

Car Importation in Kenya: Step-by-Step Guide

1. Vehicle Eligibility Requirements

To import a vehicle into Kenya, you must meet specific eligibility criteria, including a right-hand drive configuration and adherence to age restrictions as outlined in the KS 1515:2000 Kenya Standard Code of Practice for Inspection of Road Vehicles. Failing to meet these requirements will result in rejection at the port. Let’s take a closer look.

Right-Hand Drive Requirement

Kenya mandates that all imported vehicles must be right-hand drive (RHD) because the country’s traffic flows on the left side of the road. Left-hand drive (LHD) vehicles are not permitted for personal use. According to the Kenya Bureau of Standards:

"Pursuant to the provision of KS 1515:2000… only Right Hand Drive (RHD) motor vehicles whose year of first registration is from 1st January 2019 and later shall be allowed into the country effective 1st January 2026."

However, there are a few exceptions. Special-purpose vehicles such as ambulances, fire trucks, large construction machinery for government projects, vehicles donated to the Kenyan government, and those imported by recognized car collectors are exempt from this rule.

8-Year Age Limit for Imported Vehicles

From January 1, 2026, only vehicles registered on or after January 1, 2019, will be eligible for import. Note that this refers to the registration date, not the manufacturing date. Vehicles registered in 2018 or earlier will no longer qualify.

Timing plays a critical role here. The age restriction is enforced based on the date your vehicle arrives at the Kenyan port, not the purchase date. For example, if your vehicle was registered in January 2019 and shipping from Japan takes six to eight weeks, you risk missing the deadline by just one month. The Kenya Bureau of Standards has warned:

"Any vehicle registered in 2018 or earlier, arriving after 31st December 2025, will be deemed not compliant with KS 1515:2000 and shall be rejected at the importer’s expense."

To avoid costly errors, double-check the vehicle’s logbook, export certificate, and deregistration certificate through an authorized database before purchase. Also, account for shipping time to ensure your vehicle arrives within the permitted timeframe. Even a short delay can result in rejection and hefty return shipping costs.

| Import Year | Oldest Eligible Registration | Cutoff for Previous Models |

|---|---|---|

| 2025 | 2018 | December 31, 2024 (for 2017 models) |

| 2026 | 2019 | December 31, 2025 (for 2018 models) |

2. Certificate of Roadworthiness (CoR)

The Certificate of Roadworthiness (CoR) is a critical document required to confirm that your vehicle has passed pre-shipment inspection. Without it, your vehicle will be rejected at the port. This inspection ensures the vehicle is mechanically sound and has not undergone any illegal modifications.

This requirement applies to vehicles exported from countries like Japan, the United Arab Emirates, the United Kingdom, Thailand, Singapore, and South Africa. These regions have official inspection agencies appointed by the Kenya Bureau of Standards (KEBS). The purpose is to prevent unsafe vehicles from entering Kenyan roads. John Mwangi, the Director of Quality Assurance at KEBS, explains:

"This is aimed at improving road safety and ensuring better-quality vehicles on our roads."

Now, let’s look at the inspection agencies approved to issue CoRs.

Approved Inspection Agencies

Quality Inspection Services Inc. Japan (QISJ) is the primary agency authorized by KEBS to issue CoRs for vehicles from Japan, the UAE, the UK, Thailand, Singapore, and South Africa. Other recognized agencies include the Japan Export Vehicle Inspection Center (JEVIC) and the Japan Auto Appraisal Institute (JAAI).

QISJ conducts more than 150 safety checks during the inspection. These checks cover areas like roadworthiness, electrical and mechanical systems, and even radiation levels. To ensure accuracy and prevent odometer fraud, you can verify your vehicle’s mileage using the QISJ online database by entering your chassis number.

Understanding inspection costs and the consequences of missing a CoR is equally important.

Inspection Costs and Missing CoR Penalties

Inspection fees vary depending on the agency and location. For instance, JEVIC charges approximately ¥25,000 (around $170) per vehicle inspection in Japan. General pre-purchase inspections typically cost between $100 and $200, though fees may be higher for luxury or rare models.

If your vehicle arrives in Kenya without a valid CoR, KEBS will reject it. This could lead to costly re-exportation or even destruction of the vehicle. To avoid these issues, ensure the inspection is completed and the CoR is obtained before shipment. Additionally, double-check that the details on the CoR match those on your Original Logbook and Bill of Lading to prevent delays during customs clearance.

3. Customs Duties and Tax Calculations

Once you’ve tackled vehicle eligibility and inspection requirements, the next step is understanding how customs duties and taxes are calculated. This knowledge is essential for budgeting properly. The Kenya Revenue Authority (KRA) bases its tax calculations on the Current Retail Selling Price (CRSP), which is determined in collaboration with the Kenya Motor Industry Association (KMI):

"The CRSP is the price in which KRA and the Kenya Motor Industry Association (KMI) decides a brand new vehicle of the same make and model is retailing at in Kenya."

A new CRSP schedule, updated after consultations with stakeholders, took effect on July 1, 2025. Be sure to download the latest version from the KRA website before making any purchase decisions. The total amount you’ll pay includes several components: import duty (25% of the customs value or invoice price, whichever is higher), excise duty (varies by engine size), Value Added Tax (VAT), the Import Declaration Fee (IDF), and the Railway Development Levy (RDL). Below, we’ll break down the factors that influence these calculations.

Factors That Determine Duty and Tax Amounts

Three main factors play a role in determining how much you’ll pay: vehicle age, engine capacity, and body type. The KRA calculates your vehicle’s customs value by applying a 10% annual depreciation rate to the CRSP, with a maximum depreciation cap of 70%. Keep in mind that vehicles older than eight years are not eligible for import.

Timing is another critical factor. If your vehicle arrives at the Port of Mombasa before the anniversary month of its manufacture, it may be taxed 10% higher due to the "bad month" rule. This happens because the vehicle is considered a year younger for tax purposes. For example, a car manufactured in March 2018 but arriving in February 2026 would be taxed as a 7-year-old vehicle rather than an 8-year-old one, resulting in higher taxes.

Engine size significantly impacts the excise duty rate. Here’s how it breaks down:

- Vehicles with engines ≤1,500cc: 20% excise duty

- Vehicles with engines >1,500cc: 25% excise duty

- Petrol vehicles >3,000cc or diesel vehicles >2,500cc: 35% excise duty

Electric vehicles receive preferential rates, with only a 25% import duty and a 10% excise duty.

How to Use the KRA Duty Calculator

To simplify the process, you can use online duty calculators like DutyCalc or Business Radar. These tools rely on the official CRSP schedule to provide accurate cost estimates. Here’s how to use them:

- Start by selecting "Direct Import" if the vehicle is entering Kenya for the first time.

- Enter the Estimated Time of Arrival (ETA) at the Port of Mombasa and specify the country of origin.

- Provide details about the vehicle, such as make, model, body type, engine capacity, and the month/year of first registration and manufacture. This helps determine the correct depreciation rate.

- Input the shipping weight (in kilograms) and volume (in cubic meters) from your Bill of Lading.

Once you’ve entered all the information, the calculator will give you a detailed breakdown of costs, including Import Duty, Excise Duty, VAT, IDF, and RDL. Keep in mind that these estimates exclude additional expenses like freight charges to Mombasa, port handling fees, and clearing agent commissions. Be sure to account for these extra costs in your overall budget.

4. Required Import Documentation

Getting the paperwork right is a critical step when importing a vehicle into Kenya. Missing or invalid documentation can lead to hefty penalties – up to 20% of the vehicle’s value. The Kenya Revenue Authority (KRA) has a specific list of documents you’ll need to clear your car at the Port of Mombasa. Here’s what you should know about the required paperwork and how to ensure everything checks out.

Documents You Must Provide

To begin, you’ll need the original Bill of Lading, Commercial Invoice, and the logbook from the car’s country of origin. Keep in mind, KRA has a strict policy: a "Certificate of Export" won’t cut it as a replacement for the logbook. If the logbook is in a language other than English, you’ll need to get it translated. This translation must come from the embassy or consulate in Kenya.

Before the car even ships, you must submit the Import Declaration Form (IDF) through the KRA web portal. This process must be handled by a licensed clearing agent . Additionally, you’ll need a valid Certificate of Roadworthiness (as previously explained) and proof that all applicable taxes have been paid .

How to Verify Document Authenticity

Once you’ve gathered all the necessary paperwork, take steps to confirm that each document is genuine. Fraud is a widespread issue in Kenya’s vehicle import sector, with about 90% of scams involving unlicensed brokers. To safeguard your investment, verify your clearing agent’s credentials directly on the KRA website. Licensed agents typically charge professional fees starting at Ksh 6,000.

Always insist on original hard copies of documents – scanned copies are not acceptable. For added security, check if your Japanese exporter is a member of JUMVEA (Japan Used Motor Vehicle Exporters Association) and ask for at least three customer references.

For further peace of mind, consider using third-party verification services like CarVX. These platforms allow you to cross-check the vehicle’s auction history against the mileage on the dashboard and the inspection certificate. This step is crucial, as nearly 30% of imported vehicles have hidden damage that fraudulent documents might conceal.

sbb-itb-e5ed0ed

5. Emission and Safety Standards Compliance

Before exporting a vehicle to Kenya, it must pass mandatory emission and safety tests. Failing to meet these standards results in immediate rejection at the port. Kenya strictly enforces the KS 1515:2000 Code of Practice for Inspection of Road Vehicles, along with regulations outlined in Legal Notice No. 78 of July 15, 2005. These rules are non-negotiable – vehicles that don’t comply are denied entry.

Emission Compliance Certificates

All used vehicles must undergo a pre-shipment inspection approved by the Kenya Bureau of Standards (KEBS). Two primary agencies handle these inspections: JEVIC (Japan Export Vehicle Inspection Center) and QISJ (Quality Inspection Services Japan). QISJ, for example, conducts over 150 checks, including assessments of radiation levels and the vehicle’s electrical and mechanical systems.

Specialized equipment is used to test the exhaust system, ensuring the vehicle meets Kenya’s emission standards. If a car fails this test, repairs are required before it can be re-inspected. It’s essential to confirm that your Cost and Freight (C&F) agreement includes this pre-shipment inspection and to obtain the original compliance certificate, as it will be required by customs and the NTSA. These emission tests are part of Kenya’s broader commitment to maintaining strict safety and environmental standards.

Required Safety Features

Beyond emissions, inspectors carefully check critical safety components. These include headlamps, brakes, speedometers, and the undercarriage to ensure the vehicle is roadworthy and meets Kenya’s safety requirements.

6. Shipping and Customs Clearance

Shipping Methods

Once your vehicle has passed inspection, it’s time to choose a shipping method. The most common and economical option is Roll-on/Roll-off (RoRo). This method involves driving vehicles onto the ship at the port of origin and off at the destination. It’s especially practical for dealers shipping multiple cars. For added security and the ability to include approved personal items, container shipping is a better choice. If you’re shipping a luxury car and need it delivered quickly, air freight is the fastest option, though it comes with a hefty price tag. Typically, sea freight from Japan takes about 4–8 weeks, so coordinating with exporters on Cost and Freight (C&F) terms will help streamline the process.

Make sure to secure original copies of your Bill of Lading and Export Certificate. These documents are essential for customs clearance, and any delay in obtaining them could hold up the process by a month or more.

With shipping underway and your paperwork in order, you can focus on ensuring a seamless customs clearance process.

Customs Clearance Steps

To navigate customs smoothly, hire a KRA-licensed clearing agent who will handle the import entry through the iCMS system. Your agent will take care of submitting all necessary documents and coordinating the required physical inspection. After the inspection is approved, you’ll need to pay all duties and taxes directly to KRA. Clearing costs at the port generally fall between Ksh 60,000 and Ksh 120,000, depending on the size of your vehicle, while agent fees typically start at Ksh 6,000.

Most Container Freight Stations in Mombasa, like Bossfreight and Interpel, provide a 15-day free storage period. Before the vehicle is released, ask your agent to inspect it for any shipping-related damage and confirm that the mileage matches the auction sheet. Once customs issues the release, your vehicle will be ready for you to pick up.

7. NTSA Vehicle Registration

NTSA Registration Documents and Fees

Once your vehicle has cleared customs, the next step is registering it with the National Transport and Safety Authority (NTSA) via the eCitizen portal. Typically, your clearing agent handles this process, but you’ll need to provide essential documents. The most important is the original foreign logbook, which NTSA will cancel before issuing a Kenyan one.

You’ll also need to submit the following: a valid National ID or passport, your KRA PIN certificate, duty and VAT receipts, the Import Entry Form (Form 63), the original Bill of Lading, the Clean Report of Findings, and an active insurance certificate. For commercial vehicles, an additional Vehicle Inspection Report is required. Registration fees depend on your vehicle’s make and engine capacity.

After registration, you’ll need to pay Ksh 700 for the mandatory Third Licence Inspection Sticker, which is valid for 10 years. Standard number plates are issued automatically, but if you’d like triple matching number plates, you’ll pay Ksh 30,000. For those opting for customized plates, the cost is Ksh 1,000,000, with an annual maintenance fee of Ksh 50,000. Providing all required documents ensures a smooth registration process with the NTSA.

Registration Processing Time

Once you’ve submitted all the necessary documents, the registration process typically takes about two weeks. During this time, NTSA will cancel the foreign logbook and issue a Kenyan logbook along with your number plates.

To prevent delays, make sure your clearing agent registers the vehicle on the NTSA portal immediately after you settle the customs duties. While waiting for your official plates, you can use KG (Kenya Garage) plates to legally move your vehicle. Don’t forget – active insurance is required by law and will be checked during registration.

Conclusion: Steps for a Successful Vehicle Import

Successfully importing a vehicle into Kenya requires careful attention to eligibility, inspections, documentation, and tax compliance. For 2026, only vehicles manufactured in 2019 or later will qualify for importation. Missing a KEBS-approved pre-shipment inspection – such as QISJ, JEVIC, or AA Japan – can result in steep penalties or even outright rejection of your vehicle.

Once eligibility is confirmed, gather all the essential original documents. These include the Bill of Lading, Commercial Invoice, and the original foreign logbook. If the logbook is in a language other than English, you’ll need an official English translation from the relevant embassy.

Use the KRA duty calculator to estimate your import costs. These typically include:

- 25% import duty

- 20–35% excise duty (depending on engine size)

- 16% VAT

- 3.5% Import Declaration Fee

- 2% Railway Development Levy

Be cautious with your declarations, as underpayment or misdeclaration can lead to penalties of up to 20% of your vehicle’s value.

"Ensure your vehicle meets all age, compliance, and roadworthiness requirements before importation." – Knowclick Media

Once all financial obligations are settled, proceed to register your vehicle via the NTSA eCitizen portal. Ensure you upload all necessary documents to avoid delays. Typically, number plates are issued within 7 to 14 days after registration. By following these steps, you can ensure a smooth process and get your vehicle on Kenyan roads without unnecessary complications.

FAQs

Can I import a car into Kenya if it’s more than 8 years old?

No, vehicles that are more than 8 years old from their date of manufacture cannot be imported into Kenya. If your car exceeds this age limit, it will not clear customs. In such a situation, you could be forced to re-export the vehicle or face the possibility of it being seized by authorities.

To steer clear of these issues, make sure to confirm the car’s manufacture date before beginning the import process.

How can I ensure my car import documents are authentic?

To ensure your car import documents are legitimate, always insist on original copies of essential paperwork, such as the bill of lading, commercial invoice, export certificate, and vehicle logbook. These are crucial for customs clearance in Kenya. If an exporter hesitates to provide originals, consider it a warning sign.

Take the time to thoroughly check all document details, including the vehicle identification number (VIN), make, model, year of registration, and price. These details should align perfectly with the information given by the exporter or auction house. Any inconsistencies, like mismatched VINs or incorrect pricing, could signal fraudulent activity.

For added assurance, use the Kenya Revenue Authority (KRA) online verification tools or collaborate with a licensed clearing agent. These resources help confirm that the bill of lading number, import declaration form, and duty calculations match customs records. If you have a pre-shipment inspection certificate, verify its number and vehicle details with agencies like the Japan Inspection Service (QISJ). By double-checking these elements, you can confidently authenticate your documents and sidestep potential complications.

What happens if I don’t have a Certificate of Roadworthiness when importing a car into Kenya?

The Certificate of Roadworthiness is an important document you’ll need when importing a car into Kenya. Without it, your vehicle might not pass the required inspection standards, leading to potential delays, extra expenses, or even the rejection of your import application.

To steer clear of these setbacks, make sure your vehicle undergoes the necessary inspection and secures this certificate before shipping it to Kenya. This is a key step to ensure you meet Kenyan import regulations.

Related Blog Posts

- FAQ: Importing Used Cars to Kenya in 2025

- Importing a car to Kenya: costs & taxes

- Import a Car from Japan to Kenya: Costs, Duties, and How to Avoid Scams

- Car import duties in Kenya: Full guide to KRA fees and clearance