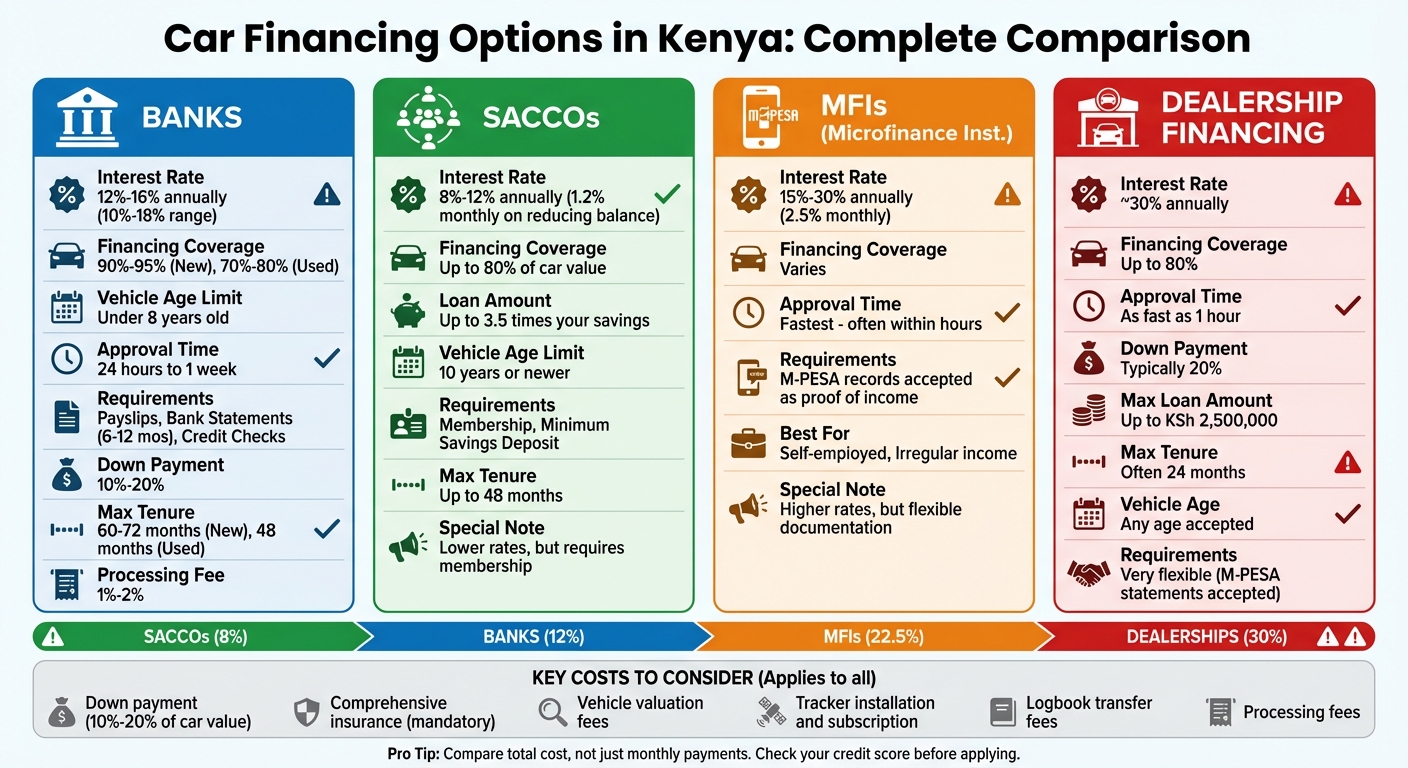

Buying a car in Kenya can feel overwhelming, but financing options make it easier for many. Here’s what you need to know:

- Banks: Offer loans with interest rates between 12%-16% annually. They require payslips, bank statements, and credit checks. Financing covers up to 90%-95% for new cars and 70%-80% for used cars (under 8 years old).

- SACCOs: Provide lower rates (8%-12%) but require membership and savings. Loans are typically 3.5 times your savings.

- Microfinance Institutions (MFIs): Approve loans faster, often using M-PESA records as proof of income. However, interest rates are higher (15%-30% annually).

- Dealership Financing: Quick approvals (sometimes within an hour) but come with higher costs (around 30% annual interest).

Key Costs to Consider:

- Down payment (10%-20% of car value)

- Comprehensive insurance

- Vehicle valuation and tracker installation

- Logbook transfer fees

Pro Tip: Check your credit score, clear debts, and calculate your budget carefully. Compare all options to find a plan that fits your financial situation and long-term goals.

Below, we’ll break down these options and their details.

Car Financing Options in Kenya: Banks vs SACCOs vs MFIs vs Dealerships Comparison

How Car Financing Works in Kenya – Bob Wa Magari Visits Royal Max Motors | #SpaceYaMagari

Check Your Financial Readiness and Eligibility

Before reaching out to a lender, take a close look at your finances. In Kenya, lenders will carefully evaluate your repayment ability by reviewing your bank statements (covering 6 to 12 months) and your most recent three months’ payslips. A key factor they consider is your debt-to-income ratio, which helps them determine if you can manage the monthly loan repayments. If a large portion of your income is already tied up in existing debts, getting approval may become a challenge. To strengthen your application, check your credit score and clear any outstanding debts.

Your Credit Reference Bureau (CRB) score is another critical piece of the puzzle. A strong score can secure you lower interest rates, while a poor one might lead to rejection or higher borrowing costs. Before applying, request your credit report and address any inaccuracies or unpaid debts. Paying off loans and settling outstanding bills can help improve your score and boost your chances of approval.

It’s also important to account for the total cost of vehicle ownership beyond the loan itself. This includes insurance, fuel, maintenance, parking fees, and installing a tracker. Most lenders require a down payment of 10% to 20% of the car’s value. For instance, specialized lenders like MOGO typically ask for 20% upfront. On the other hand, banks like Access Bank offer up to 90% financing for new vehicles, while Absa Bank can finance up to 95% for new cars. If you’re eyeing a used car, expect financing to cover 70% to 80% of the cost, provided the car is no older than 8 years.

Calculate Your Budget and Credit Score

Once you’ve reviewed your finances, calculate what you can realistically afford each month. Be sure to include loan installments (which can start as low as KES 20,000 per month), recurring expenses like insurance and fuel, and hidden costs such as valuation fees, negotiation charges, and tracker installation.

Your CRB score plays a pivotal role in determining your loan terms. Lenders use this score to set interest rates. If you’re self-employed or have irregular income, Microfinance Institutions (MFIs) might be a better option since they often accept M-PESA statements as proof of financial activity. However, MFIs usually charge higher interest rates – around 2.5% per month, which adds up to roughly 30% annually. In contrast, traditional banks charge lower rates, typically between 14% and 18% per year.

Review Eligibility Requirements

Most lenders have specific eligibility criteria. Applicants generally need to be between 23 and 70 years old and must provide a valid National ID or passport along with a personal KRA PIN. If you’re salaried, you’ll also need a formal letter of introduction from your employer, confirming your job title, salary, and employment status. Self-employed individuals should prepare six months of bank or M-PESA statements.

Additionally, a professional vehicle valuation is required. Lenders use the car’s Forced Sale Value (FSV) – the price it could fetch in a quick sale – to minimize their risk in case of default. Repayment terms differ based on the type of car: used vehicles typically have a maximum financing period of 48 months (4 years), while new cars may qualify for up to 72 months (6 years). For example, Access Bank charges a processing fee of about 1% of the loan amount.

Make sure you can meet these requirements while comfortably budgeting for the ongoing costs of owning a vehicle.

| Requirement | Typical Detail |

|---|---|

| Minimum Age | 23 years |

| Maximum Age | 70 years |

| Income Proof (Salaried) | 3 months payslips + 6-12 months bank statements |

| Income Proof (Self-Employed) | 6 months M-PESA or bank statements |

| Mandatory Documents | National ID, KRA PIN, Vehicle Valuation Report |

Bank Loan Options

Kenyan banks provide structured car financing solutions with competitive interest rates. Most banks use the reducing balance method, where interest is calculated on the outstanding loan balance rather than the original principal. This means as you repay the loan, your interest charges decrease, making the overall cost more manageable over time. Below is a breakdown of the key features of bank car loans.

Features of Bank Car Loans

Banks in Kenya typically finance between 80% and 100% of a car’s value. For new vehicles, repayment terms can go up to 60 months (5 years), while loans for used cars are usually capped at 48 months (4 years). During the repayment period, the vehicle is registered as collateral until the loan is fully paid off.

Interest rates generally follow the Central Bank of Kenya‘s base rate plus a margin. For example, SBM Bank applies a rate of Base Rate + 3.1% for new cars and Base Rate + 4% for used cars. Across the market, rates typically range between 10% and 20% annually. Processing fees are usually 1%–2% of the loan amount. Borrowers are also required to maintain comprehensive insurance for the entire loan term. Some banks, like SBM Bank, even offer a 60-day repayment moratorium.

Understanding these features can help borrowers evaluate and compare loan options across different banks.

Comparison of Bank Loan Options

| Bank | Max Financing (New) | Max Financing (Used) | Max Tenure (New) | Max Tenure (Used) | Processing Fee | Interest Rate Structure |

|---|---|---|---|---|---|---|

| Access Bank | 90% | 80% | 60 months | 48 months | 1% | Base rate + margin |

| I&M Bank | 85% | 80% | 72 months | 48 months | 1–2% | Variable |

| National Bank | 100% | 100% | 60 months | 48 months | 1–2% | Variable |

| SBM Bank | 100% | 100% | 60 months | 60 months | 1.5% (new) / 2% (used) | Base + 3.1% (new) / Base + 4% (used) |

Banks determine financing based on the car’s Forced Sale Value (FSV), which can differ significantly from its market value. This often means buyers may need to provide a larger down payment. Additionally, most banks require that used cars be less than 8 to 10 years old to qualify for financing.

SACCOs and Hire Purchase Options

In Kenya, car buyers have additional financing options through SACCOs and hire purchase agreements, which provide flexibility for those seeking alternatives to traditional bank loans.

SACCO Car Financing

Savings and Credit Cooperative Organizations (SACCOs) operate as member-driven institutions where pooled savings fund loans. To qualify for car financing with a SACCO, you must first become a member and maintain a minimum deposit. Typically, SACCOs offer loans up to 3.5 times your savings. For instance, securing a KSh 3,500,000 loan would generally require deposits of around KSh 1,000,000.

Some SACCOs, like Amref SACCO, provide financing for up to 80% of a car’s value, with loan amounts reaching as high as KSh 5,000,000. Their interest rates are about 1.2% per month on a reducing balance, and repayment terms can extend up to 48 months. The financed vehicle acts as collateral and must be 10 years old or newer. Additionally, if you deposit a significant lump sum – say, over KSh 500,000 – many SACCOs enforce a waiting period of 30 to 60 days before you can borrow against it.

SACCO loans often come with lower interest rates compared to commercial banks. However, there are extra costs to consider, such as comprehensive insurance (typically required for at least three years), car tracking devices, and professional vehicle valuation services.

For those who prefer a structured payment plan with delayed ownership, hire purchase agreements are another option to explore.

Hire Purchase Agreements

Hire purchase agreements allow you to buy a vehicle through an upfront deposit and fixed monthly installments. Under this arrangement, the lender retains legal ownership of the car (noted as "Owner 1" on the NTSA logbook), while you’re listed as "Owner 2." Full ownership transfers to you only after completing all payments.

This financing model works well for self-employed individuals or those with inconsistent incomes. Many hire purchase providers accept alternative proof of income, such as M-PESA transaction records. For example, MOGO’s Standard Financing requires a 20% down payment for loans up to KSh 2,500,000, with repayment terms of up to 24 months. Alternatively, their Super Flexi option often requires a 50% deposit for loans capped at KSh 700,000.

Interest rates for hire purchase agreements usually range between 10% and 18% per year, which can be higher than SACCO or bank rates. Before committing to a hire purchase agreement, ensure the seller initiates the NTSA In-Charge process to reflect joint ownership accurately. Additionally, obtaining a professional valuation to assess the vehicle’s forced sale value is strongly recommended.

Both SACCOs and hire purchase agreements provide flexible financing solutions, making them practical alternatives to bank loans for Kenyan car buyers.

sbb-itb-e5ed0ed

Dealership and Specialized Financing Plans

In addition to banks and SACCOs, Kenyan car buyers have other financing options designed for those seeking quicker approvals or who might not meet traditional documentation requirements. Dealership-affiliated lenders and microfinance institutions (MFIs) step in to fill this gap, offering accessible solutions for individuals with non-traditional income sources or those who need financing in a hurry. Here’s a closer look at how dealership financing stands out from other methods.

Dealership Financing Plans

Dealerships often collaborate with specialized lenders like MOGO to provide fast and flexible financing options. For instance, MOGO can approve loans in as little as one hour, a stark contrast to the 24 hours to one week that banks typically require. These plans usually finance up to 80% of the vehicle’s value, leaving buyers to cover a 20% down payment. Loan amounts can go up to KSh 2,500,000, with repayment periods capped at 24 months.

One major advantage of these lenders is their relaxed documentation requirements. For self-employed buyers who lack traditional payslips, MOGO accepts six months of M-PESA transaction records. Additionally, they finance vehicles of any age, unlike banks, which often restrict loans to cars less than eight years old.

However, this convenience comes at a price. Interest rates for MFI car loans hover around 2.5% per month, translating to roughly 30% annually – significantly higher than the 10% to 18% annual rates offered by commercial banks. On top of that, buyers must still budget for standard expenses like comprehensive insurance, car tracking systems, and professional vehicle valuations.

Dealership vs. Bank Financing Comparison

When deciding between dealership financing and bank loans, it’s essential to balance the need for speed against the overall cost. The table below highlights the main differences:

| Feature | Bank Financing | Dealership/Specialized Financing |

|---|---|---|

| Interest Rate | 10%–18% per year | Approximately 30% per year (2.5% per month) |

| Approval Speed | 24 hours to 1 week | 1 hour to 24 hours |

| Down Payment | 0%–20% | Typically 20% |

| Documentation | Strict (bank statements, payslips) | Flexible (M-PESA statements accepted) |

| Vehicle Age Limit | Often under 8 years | Any age, make, or model |

| Maximum Loan Term | Up to 60–72 months | Often shorter (e.g., 24 months) |

Your choice will depend on your priorities – whether you value fast approval or prefer lower interest rates. Make sure to calculate the total cost of the loan, not just the monthly payments, before committing to any plan.

How to Make an Informed Decision

After exploring various financing options, it’s time to focus on making a well-thought-out decision and preparing your application. The difference between securing a favorable deal and making a costly mistake often depends on how carefully you calculate the total costs and organize your paperwork. By following a structured approach, you can avoid errors and ensure you’re fully prepared.

Use Loan Calculators and Compare Total Costs

When considering loans, don’t just focus on the monthly payments – look at the total cost. For example, a 72-month loan might seem appealing because of lower monthly installments, but you’ll end up paying much more in interest compared to a shorter loan term. In Kenya, bank loan interest rates typically range between 10% and 18% annually, while microfinance loans often come with even higher rates.

Beyond the loan itself, remember to include the total cost of ownership in your calculations. This includes expenses like comprehensive insurance (required by lenders), car tracker installation and subscription fees, NTSA logbook transfer charges, fuel, maintenance, and parking. Also, be mindful of additional lender fees that may apply.

Online comparison tools can help you evaluate multiple lenders side by side, making it easier to identify the best option. Pay close attention to the Forced Sale Value (FSV) – this is the amount banks use to determine what your car would sell for quickly in case of default. If the dealer’s asking price is significantly higher than the market valuation, the car might be overpriced.

Prepare Your Application

Proper preparation can speed up the approval process. Start by double-checking your eligibility and gathering all necessary documents. This includes items like a letter of introduction from your employer, a pro-forma invoice from the car dealer, and, if you’re purchasing a used car, a copy of the logbook. For companies, additional paperwork such as a Certificate of Incorporation, KRA PIN, and directors’ IDs will be required.

Before submitting your application, it’s wise to review your Credit Reference Bureau (CRB) report to ensure there are no errors that could disqualify you. A clean report can make all the difference in your approval process.

Avoid Common Pitfalls

Be aware of hidden costs, such as valuation, legal, and negotiation fees, which some lenders might not disclose upfront. While advertised rates may seem attractive, these additional fees can quickly add up.

Choose your repayment term wisely. A shorter term, like 24 months, means higher monthly payments, which could strain your budget. On the other hand, extending the term lowers monthly payments but significantly increases the total interest you’ll pay over time. Also, check the vehicle’s age – most banks won’t finance cars older than seven or eight years, so ensure the car you’re considering meets this requirement.

Keep in mind that during the loan period, the lender will be listed as the primary owner on the NTSA TIMS logbook (Owner 1), while you will be listed as Owner 2. This joint ownership remains in place until the loan is fully repaid. Missing payments could result in repossession, so it’s crucial to stay on top of your installments.

With these steps and considerations, you’ll be better equipped to finalize your financing decision confidently and responsibly.

Conclusion

Financing a car in Kenya calls for careful planning and informed decision-making. Start by evaluating your budget, credit score, and how much you can realistically afford to pay each month. A good rule of thumb is to keep car payments within 25% to 30% of your gross monthly income. Kenya offers a variety of financing options: banks typically charge interest rates of 10%–16%, SACCOs provide more competitive rates ranging from 8% to 12.75% for members who have adequate savings, and microfinance institutions, while faster – sometimes approving loans in under an hour – come with higher rates. Understanding these options is key to making a choice that aligns with your financial plans.

It’s also essential to look beyond just the interest rate. Consider additional costs like processing fees, insurance, tracker installation, and valuation fees. While it might be tempting to lower your monthly payments by extending the loan term, this can significantly increase the total interest you’ll pay over time.

To navigate these decisions, use online tools to compare offers, negotiate with lenders, and ensure you have all the necessary documentation ready. Keep in mind that many banks prefer to finance cars that are no older than seven or eight years. By thoroughly researching and comparing options, and steering clear of common pitfalls like hidden fees or overly long loan terms, you can secure a financing plan that works for your budget and long-term goals. Take the time to explore your options and start comparing offers to find the deal that’s right for you.

FAQs

What are the advantages and disadvantages of financing a car through a dealership versus a bank in Kenya?

When it comes to dealership financing, the process is undeniably convenient. You can take care of both buying the car and securing financing in one spot, often with the added perk of same-day approval. Some dealerships sweeten the deal with promotions or discounts tied to specific manufacturers. But here’s the catch: higher interest rates and limited wiggle room for negotiation can drive up the overall cost of your loan.

On the flip side, bank loans usually come with lower interest rates and sometimes even perks, like discounts for existing customers. Plus, having your financing sorted through a bank can give you an edge at the dealership since you’ll be seen as a cash buyer, which can improve your bargaining position. That said, bank loans aren’t without their drawbacks. They often involve a more detailed credit check, take longer to process, and need to be secured before you step foot in the dealership.

How can I boost my credit score to qualify for better car loan terms in Kenya?

Improving your credit score is a smart move if you’re looking for better car loan terms in Kenya. Start by making it a priority to pay all your bills on time – late payments can drag your score down. It’s also a good idea to regularly review your credit report for errors. If you spot any inaccuracies, reach out to the credit bureau to dispute them.

Another key step is reducing your existing debt and keeping your credit utilization ratio low. Be cautious about applying for multiple loans or credit lines in a short time, as this can hurt your score. If you can, focus on building a strong credit history by responsibly managing smaller loans or credit products before taking the leap into a car loan. Small steps like these can make a big difference.

What extra costs should I consider when financing a car in Kenya?

When financing a car in Kenya, it’s crucial to plan for expenses beyond just your monthly loan payments. Import and registration fees can make a significant difference in the overall cost of an imported car. These include import duty (roughly 25% of the customs value), excise duty (ranging from 20% to 30% depending on engine size), and a 16% VAT. Combined, these fees can add anywhere from $5,000 to $10,000 to the car’s price. On top of that, you’ll need to cover NTSA compliance inspections, registration plates, and annual licensing fees.

Insurance is another key expense. While third-party insurance is mandatory, many buyers prefer comprehensive coverage. The cost for this typically ranges from $90 to $270 per year, depending on factors like the car’s value and your driving history. Additionally, lenders often charge loan processing fees (around 1% of the loan amount), documentation fees, and sometimes penalties for early repayment. Dealers might also include "on-the-road" costs, such as delivery and administrative fees, in your financing package.

Then there are the ongoing costs of owning a car. These include road tax, regular maintenance, tire replacements, and occasional repairs. Being mindful of these additional expenses can help you plan your budget more effectively and avoid unexpected financial strain after buying your car.

Related Blog Posts

- Car Loan Eligibility in Kenya: Key Factors

- Car insurance costs in Kenya

- Step-by-Step Guide to Buying a Car in Kenya (2025 Edition)

- How to Get Car Financing in Kenya: Tips for First-Time Buyers