Buying a used car in Kenya can save you money, but without proper precautions, it could lead to financial loss or safety risks. Here are the top mistakes to avoid:

- Skipping a mechanical inspection: Hidden issues like engine wear or faulty brakes can cost you later.

- Not verifying ownership and logbook details: Ensure the seller’s details match NTSA records to avoid legal troubles.

- Ignoring hidden costs: Budget for transfer fees, insurance, and potential repairs, which can add 15-20% to the purchase price.

- Failing to research market value and reliability: Compare prices and choose models with accessible spare parts.

- Skipping a test drive: Test the car on various roads to check for alignment, suspension, or engine problems.

- Overlooking NTSA TIMS compliance: Confirm the car’s history, including loans or legal restrictions.

- Falling for deals that seem too good to be true: Be cautious of low prices and unverified sellers.

Take your time, verify everything, and don’t rush into deals. A careful approach can save you from expensive mistakes and ensure a safer purchase.

Hidden Costs of Buying a Used Car in Kenya: Budget Breakdown

Don’t Get Scammed! The RIGHT Way to Buy & Transfer Ownership of a Car in Kenya

1. Skipping a Pre-Purchase Mechanical Inspection

A car might shine on the outside, but that doesn’t guarantee everything under the hood is in tip-top shape. Getting a professional mechanic to inspect the vehicle before buying is a step you can’t afford to skip. This precaution can save you from ending up with a "lemon" – a car riddled with hidden issues. A thorough inspection digs deeper than what meets the eye, identifying problems you’d likely miss.

Mechanics look for issues such as engine wear, transmission problems, signs of previous accidents, and even odometer tampering. Tools like magnets can reveal body filler hiding rust or dents, while mismatched paint or fresh welds might point to major repairs. Henry Mbugua, Manager at Autochek Kenya, highlights one specific detail to watch for:

"Loose or misaligned rubber seals around the doors, as damaged or ill-fitting rubber could indicate underlying issues such as water leaks, wind noise, or structural problems".

The inspection should also cover critical safety features like brakes and airbags, along with fluid conditions. For example, gritty or dark oil can be a sign of poor maintenance. Even the exhaust can tell a story – blue smoke might mean the engine is burning oil, while black smoke could point to fuel system troubles. Uneven tire wear could hint at alignment or suspension problems, and dashboard warning lights shouldn’t be ignored.

Services like Automotive Doctor and Peach Cars specialize in pre-purchase inspections, helping you verify if the car’s condition aligns with its claimed mileage. As Peach Cars aptly puts it:

"If the car is ‘low mileage’ but looks like it’s survived a Mad Max movie, walk away!".

If the inspection uncovers issues, you can use that information to negotiate a better deal. Plus, experts suggest setting aside at least 10% of your total budget for unexpected repairs during the first six months. A professional inspection isn’t just about peace of mind – it’s about avoiding expensive surprises down the road.

2. Not Verifying Logbook and Ownership Details

After a mechanical inspection, the next crucial step is confirming ownership to steer clear of legal troubles. The logbook serves as proof of the seller’s ownership. Skipping this step could leave you with a vehicle tied to unpaid loans or legal disputes. Always ensure that the seller’s details on the logbook match their official ID and KRA PIN.

Conduct an official motor vehicle search through the National Transport and Safety Authority (NTSA) TIMS portal or eCitizen platform. For Ksh 550 (about $4.25), you’ll receive a "Copy of Records", which includes the current legal owner, vehicle specifications, and any caveats or encumbrances. Mercy Nekesa, Sales Admin at Peach Cars, emphasizes:

"The NTSA motor vehicle search will provide you with a copy of records that will enable you to confirm with the seller’s documents before purchase".

Once you’ve verified the details online, inspect the vehicle in person. Check the chassis and engine numbers, ensuring they match the logbook and NTSA records. Any mismatch could mean the car is a clone or has been tampered with. Also, look for caveats, which are legal restrictions like unpaid loans or court orders that prevent ownership transfer. Dan Kauna, writing for Pulse Live, advises:

"Ensure the seller’s name matches their ID and that there are no outstanding loans or encumbrances (claims on the vehicle)".

After confirming the details, proceed with the transfer process. The seller initiates the transfer online via the NTSA portal, and you accept it digitally – no physical paperwork required. Draft a signed sales agreement outlining the vehicle’s condition, price, and transfer date. For payment, use bank transfers or bankers’ cheques instead of cash to maintain a verifiable record.

Transfer fees depend on the engine size: vehicles up to 1,000 cc cost Ksh 1,660 (about $12.80), while those over 3,000 cc cost Ksh 5,915 (around $45.70). Keep in mind, the transfer must be completed within 14 days of purchase. Driving a vehicle under the previous owner’s name beyond this period is illegal under the Traffic Act.

3. Ignoring Hidden Costs Beyond the Purchase Price

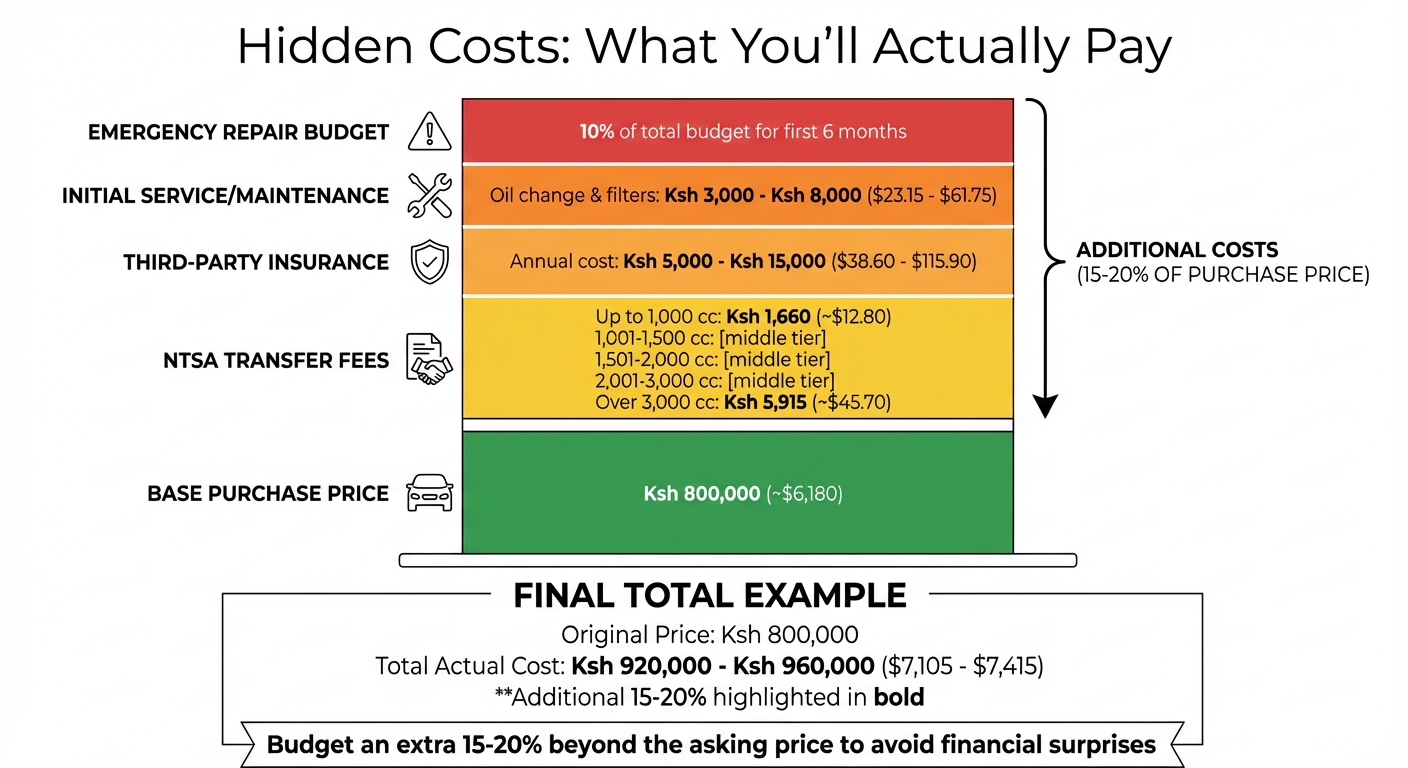

The price tag on a car is just the starting point. Many buyers focus solely on negotiating the purchase price, only to be caught off guard by additional fees and immediate expenses. These hidden costs can add 15-20% to the total amount, so it’s crucial to calculate them in advance to avoid any budget shocks.

One of the first expenses you’ll encounter is statutory fees and mandatory insurance. For instance, the NTSA transfer fees depend on the engine size of the vehicle. Transferring ownership of a smaller car (up to 1,000 cc) costs Ksh 1,660 (around $12.80), while for larger vehicles above 3,000 cc, the fee is Ksh 5,915 (approximately $45.70). Then there’s third-party insurance, the legal minimum in Kenya, which typically ranges between Ksh 5,000 and Ksh 15,000 ($38.60 to $115.90) annually. As Peach Cars highlights:

"The minimum cover you can have is Third Party Only (TPO) cover. An insurance cover protects you against financial and legal liabilities in case you get into an accident".

Beyond these initial fees, basic servicing costs can also add up quickly. A routine service, such as an oil change and filter replacement, can run between Ksh 3,000 and Ksh 8,000 ($23.15 to $61.75). And don’t forget unexpected repairs. It’s wise to allocate at least 10% of your total budget for potential fixes during the first six months. These could include worn brake pads, suspension issues, or electrical problems that might not have been apparent during the test drive.

When you account for all these expenses, the true cost of a car becomes clearer. For example, a used car priced at Ksh 800,000 (~$6,180) could end up costing between Ksh 920,000 and Ksh 960,000 ($7,105–$7,415) once you factor in transfer fees, insurance, and initial repairs. By including these costs in your calculations from the start, you’ll be better prepared and less likely to face financial surprises down the road. This approach not only complements your earlier checks but also helps protect your investment in the long run.

4. Failing to Research Market Value and Model Reliability

After confirming a vehicle’s history and condition, the next step is understanding its market value and reliability. Skipping this research can lead to costly mistakes. Before arranging a viewing, take some time to browse multiple online classifieds to see what similar models are being sold for in Kenya. Pay attention to details like the year, mileage, and condition of the vehicles to pinpoint a fair price range. If you stumble upon a deal that’s way below the market average, proceed with caution – it could signal hidden issues like mechanical problems, unpaid debts, or other concerns.

Reliability is just as critical as pricing. In Nairobi, Japanese brands like Toyota, Nissan, and Honda are highly popular because they offer easy access to spare parts and have a reputation for dependable performance. Considering that the average car in Kenya is about 15 years old, breakdowns are a common challenge. Opting for a model with strong aftermarket support can save you from the frustration of hunting for rare or counterfeit parts.

When evaluating a vehicle, always check its service records to verify that the mileage is accurate – low mileage typically means under 150,000 km (around 93,000 miles). Be cautious with high-mileage vehicles, as they often come with higher maintenance costs. Comparing the odometer reading against service records can also help you spot signs of tampering.

For added assurance, the NTSA portal allows you to verify recorded mileage and accident history for just Ksh 500 (approximately $3.85). This small investment can confirm the seller’s claims and give you peace of mind. By combining thorough market research with reliability checks, you’ll be better equipped to negotiate confidently, avoid unexpected expenses, and make a well-informed purchase decision.

sbb-itb-e5ed0ed

5. Buying Without a Thorough Test Drive

A test drive isn’t just a box to check – it’s your best chance to spot mechanical problems that might not show up during a visual inspection. Spending at least 15 minutes driving on different road surfaces can reveal how the car performs in real-world conditions. Start by focusing on how the vehicle behaves during startup and while on the move, as these moments can expose issues a static check might miss.

Always insist on starting the car when the engine is cold. This will give you a clearer picture of how well it ignites. Pay attention to how easily it starts and note any odd sounds or smoke during those first moments. Once you’re on the road, observe how the car accelerates. A smooth response is key – watch out for hesitation, jerking, or "flat spots" when merging into traffic. Keep the radio off so you can listen for unusual noises like knocking, rattling, or whining from the engine. After assessing the startup and acceleration, take the car through a variety of road conditions to get a complete feel for its performance.

Driving on rough or bumpy roads is a must. This helps you identify suspension problems like excessive bouncing or squeaking. On highways, briefly loosen your grip on the steering wheel to check if the car drifts to one side – this could be a sign of alignment issues. In stop-and-go city traffic, test the brakes for responsiveness and listen for squeals or grinding noises, which might indicate worn brake components. These conditions also provide a chance to see how the cooling system manages under stress.

For manual transmissions, make sure the gears shift smoothly without grinding. In automatics, the gear changes should feel seamless. Throughout your drive, keep an eye on the dashboard for any warning lights that stay on. After the test drive, don’t forget to inspect the ground where the car was parked. Any fresh oil or fluid leaks could hint at underlying problems.

6. Overlooking NTSA TIMS Compliance and Vehicle History

After completing thorough mechanical inspections and verifying ownership, the next step is ensuring compliance with the NTSA TIMS system. Ignoring this step can lead to serious risks. NTSA TIMS, Kenya’s official online platform for vehicle registration, ownership transfers, and licensing, became part of the eCitizen portal on December 27, 2023. Conducting an official vehicle search through this system costs KES 550 and provides key information like the registered owner’s name, chassis and engine numbers, and any legal restrictions. This check is essential in confirming the vehicle’s complete history.

"Checking the ownership of a car can protect buyers from scams involving stolen vehicles or those with financial encumbrances."

– Eleven Motors

One major warning sign to look for in NTSA records is joint ownership or legal caveats. If a bank or microfinance institution is listed as a co-owner, it likely means the vehicle is still being used as collateral for an unpaid loan. In such cases, the seller must provide a discharge letter and an updated logbook showing only their name before you can proceed with the transfer. Similarly, discrepancies between the chassis or engine numbers in the TIMS records and the actual car could mean the vehicle is stolen or assembled from salvaged parts.

It’s also important to compare the last recorded mileage in the NTSA system with the car’s current odometer reading. If the dashboard shows a lower number, it could indicate odometer tampering. Additionally, a vehicle that has changed hands multiple times in a short period might be hiding unresolved mechanical issues or a questionable history.

To perform this verification, log into the eCitizen portal at www.ecitizen.go.ke, go to the NTSA section, select "Copy of Vehicle Register Record", enter the registration plate, and pay the fee via M-Pesa (business number 206206). Double-check that all details – make, model, color, and year – align with the actual vehicle. If the seller refuses to allow this check or the records reveal inconsistencies, it’s a clear sign to walk away.

7. Falling for Too-Good-to-Be-True Deals from Unverified Sellers

Once you’ve done your inspections and checked all the records, there’s one more thing to watch out for: scams from unverified sellers. Let’s face it – if a deal seems too good to be true, it probably is. Offers that slash prices by 50% or more on sought-after models are almost always traps set by scammers looking to exploit unsuspecting buyers.

"If the price appears significantly lower than the market rate for a similar make and model, it is essential to investigate further."

– Henry Mbugua, Manager, Autochek Kenya

But it’s not just suspiciously low prices that should raise red flags. Scammers often use high-pressure tactics to push you into making snap decisions. They might claim there’s a line of eager buyers or demand immediate payment to "secure" the deal. Watch out for sellers who refuse to meet in person, won’t allow a mechanic to inspect the car, or say the vehicle isn’t in their possession. On social media, keep an eye out for profiles that were created recently or have little to no posting history – classic signs of a scammer.

Before you hand over a single dollar, make sure the seller’s identity matches the registered owner in the NTSA system. If someone claims to be selling on behalf of the owner, ask for a formal letter of authorization to back it up. Many buyers fall victim simply because they skip these basic checks and get swept up by the allure of a low price.

For added protection, insist on a signed sales agreement that spells out the purchase price, payment method, and timeline for transferring the logbook. Always meet sellers in public places during daylight hours, and let friends or family know where you’ll be for extra safety.

Conclusion

Buying a used car in Kenya can be a smart move if you approach it carefully. The seven mistakes we’ve discussed – like skipping a mechanic’s inspection or being tempted by unrealistically low prices – share one thing in common: they’re avoidable with proper research and due diligence. Spending on an NTSA search or hiring a mechanic to inspect the car upfront can save you from expensive legal troubles or hidden mechanical problems later on.

Verification is your best defense. A detailed mechanical inspection can uncover issues like brake defects, which are among the leading causes of fatal accidents in Kenya. Planning ahead for hidden costs, such as repairs or transfer fees, also helps ensure your purchase stays within budget.

The most important step? Don’t rush. Take your time with every part of the process, including a proper test drive of at least 15 minutes on both city streets and highways. These steps can turn what might feel like a risky decision into a confident, informed purchase. Kenya’s used car market offers plenty of reliable options at fair prices – you just need to know how to spot the genuine deals and steer clear of traps. By following these practical tips, you’ll navigate the market with confidence and avoid common mistakes.

FAQs

What should I check during a mechanical inspection before buying a used car?

Before purchasing a used car, it’s a smart move to have a trusted mechanic give it a thorough inspection. Start by focusing on the engine – watch for leaks, unusual noises, low or dirty oil, and any signs of smoke. Also, take a closer look at the coolant level, along with the condition of the belts, hoses, and battery terminals.

Don’t skip over the suspension, brakes, and tires – check for wear, damage, or anything that looks off. Once you’ve done that, take the car out for a test drive. Pay attention to how it handles, accelerates, brakes, and feels overall on the road. A careful review like this can save you from unexpected repair bills down the line.

How can I confirm the ownership and logbook details of a used car in Kenya?

To steer clear of scams when purchasing a used car in Kenya, it’s essential to verify the ownership and logbook details. The logbook serves as the official proof of ownership, and any inconsistencies could point to problems like theft or unpaid loans.

The first step is to confirm the logbook’s details through the NTSA TIMS portal or its mobile app. Both the buyer and the seller should have NTSA accounts linked to their national ID numbers. The seller uploads the vehicle’s details, and the system checks whether the logbook aligns with the seller’s ID and registration records. Alternatively, you can verify ownership by texting the vehicle’s license plate number to 22846 using the NTSA SMS service.

Take a closer look at the logbook itself to ensure it’s genuine. Check for features like watermarks, holograms, and serial numbers. If the car was recently imported, use the KRA portal to confirm tax and import clearance. For added peace of mind, visit an NTSA office to request an official vehicle search report. This report will provide the car’s ownership history and confirm that it’s free of unpaid duties or legal complications. Following these steps can help you confidently verify the car’s ownership before finalizing your purchase.

What unexpected costs should I budget for when buying a used car?

When purchasing a used car, it’s crucial to consider the hidden costs that might not be immediately apparent. These could range from replacing worn tires to fixing suspension issues or addressing other mechanical problems. Don’t forget about administrative expenses like logbook transfer fees, which can also sneak up on you.

On top of that, ongoing costs such as insurance, fuel, and registration taxes can quickly add to your overall expenses. To avoid any unexpected financial strain, have a trusted mechanic inspect the vehicle thoroughly and review all related fees before sealing the deal.

Related Blog Posts

- Where to buy certified used cars in Kenya

- What to Look Out for When Buying a Second-Hand Car in Kenya

- Step-by-Step Guide to Buying a Car in Kenya (2025 Edition)

- Buying a Used Car in Kenya? Avoid These 5 Mistakes