In Kenya, car insurance is required by law, with Third-Party Only (TPO) coverage being the minimum standard. This article explains the costs, types of coverage, and ways to save on premiums in 2026. Key takeaways:

- Types of Coverage:

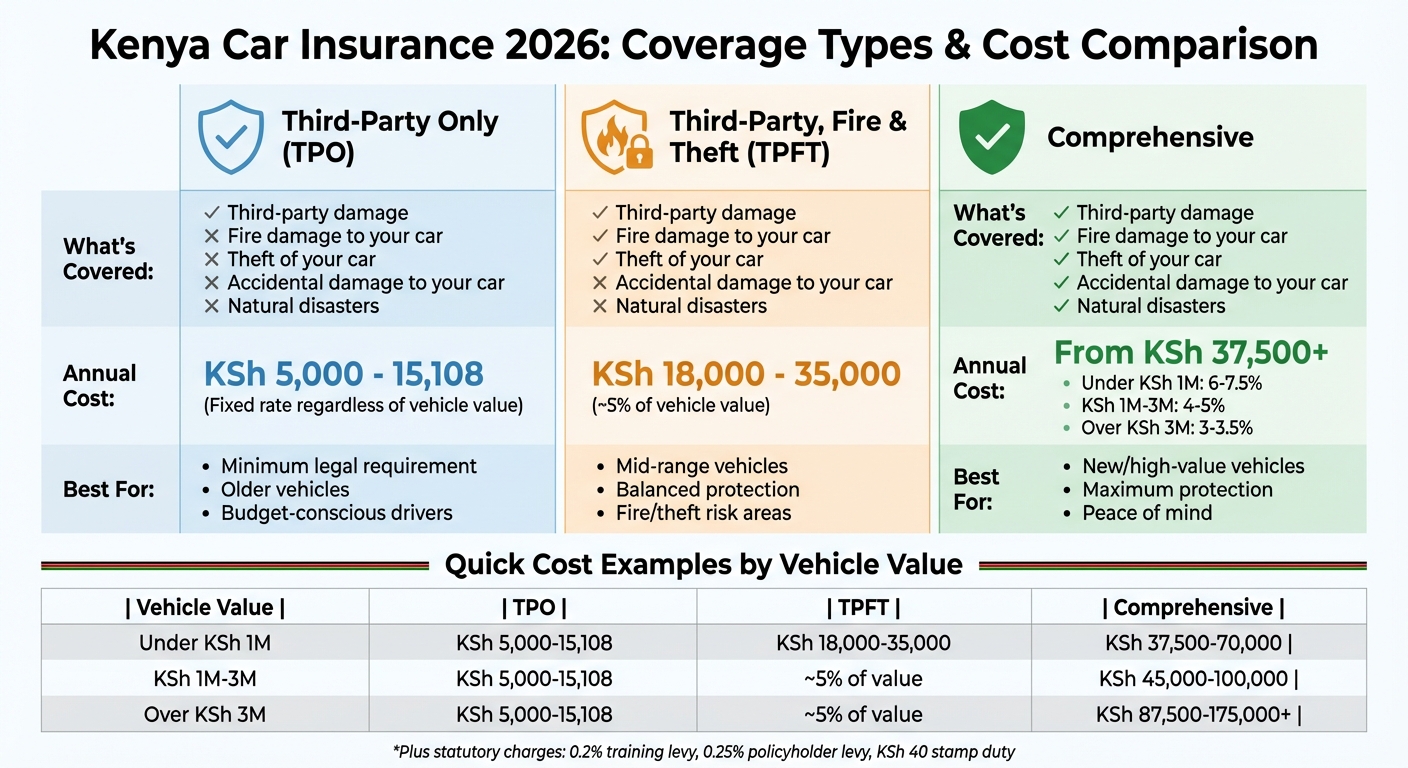

- Third-Party Only (TPO): Covers damages to others but not your car; costs range from KSh 5,000–15,108 annually.

- Third-Party, Fire, and Theft (TPFT): Adds protection for fire and theft; premiums are around 5% of your vehicle’s value.

- Comprehensive: Covers your car and third-party liabilities; rates vary from 3%–7.5% of your car’s value.

- Factors Influencing Premiums:

- Car value and type: Higher-value or rare vehicles cost more to insure.

- Driver history: Clean records and No Claims Discounts (NCD) lower costs.

- Location: Urban or high-crime areas lead to higher premiums.

- Vehicle use: Commercial and Public Service Vehicles (PSVs) have higher rates.

- 2026 Insurance Costs:

- TPO: KSh 5,000–15,108.

- TPFT: KSh 18,000–35,000.

- Comprehensive: Starts at KSh 37,500 and varies with car value.

- Money-Saving Tips:

- Opt for higher deductibles to reduce premiums.

- Bundle multiple policies for discounts.

- Maintain a clean driving record for NCD benefits.

- Compare quotes from different insurers.

Understanding these factors can help you choose the right policy and reduce your costs effectively.

Kenya Car Insurance Coverage Types and Costs Comparison 2026

How to buy the right car insurance (and save money)!

Types of Car Insurance in Kenya

In Kenya, drivers have three main types of car insurance to choose from. Each option provides a different level of protection, so understanding these differences is key to choosing a policy that fits your needs and budget.

Third-Party Only Coverage

This is the most basic insurance required by law under Chapter 405 of the Kenya Traffic Act. Third-Party Only (TPO) coverage focuses solely on liabilities for injuries, death, property damage, and legal costs affecting others if you’re at fault in an accident. However, it does not cover any damage to your own car. For instance, if your car is damaged in a hit-and-run, you’ll need to pay for the repairs yourself. Annual premiums for TPO coverage are relatively affordable, usually ranging from KSh 5,000 to KSh 10,000. Insurance providers like Madison Insurance and The Monarch Insurance offer policies in this price range.

Comprehensive Coverage

Comprehensive insurance provides the broadest protection. It covers third-party liabilities and also includes damage to your own vehicle, regardless of fault. Additionally, it often protects against risks like fire, theft, vandalism, and natural disasters such as floods or earthquakes. Premiums are calculated as a percentage of your car’s value, typically starting at 3.2% to 3.5% and going up to 7%, depending on factors like the car’s age and condition. For example, APA Insurance offers comprehensive plans with annual premiums between KSh 25,000 and KSh 60,000, while Jubilee Insurance charges between KSh 24,000 and KSh 55,000. This type of coverage is ideal for newer or high-value vehicles, where repair or replacement costs can be overwhelming. Keep in mind, most insurers require your car to be less than 15 years old or valued at over KSh 500,000 to qualify for comprehensive coverage.

Third-Party Fire and Theft Coverage

This option sits between TPO and comprehensive coverage. Third-Party, Fire and Theft (TPFT) insurance includes all the basic protections of TPO but adds coverage for fire damage and theft of your vehicle. However, it doesn’t cover accidental damage to your car. Premiums for TPFT are typically around 5% of your vehicle’s value. Providers like CIC Insurance and Sanlam Insurance offer TPFT policies, with annual premiums ranging from KSh 18,000 to KSh 35,000.

| Feature | Third-Party Only (TPO) | Third-Party, Fire & Theft (TPFT) | Comprehensive |

|---|---|---|---|

| Third-Party Damage | Covered | Covered | Covered |

| Fire Damage to Your Car | Not Covered | Covered | Covered |

| Theft of Your Car | Not Covered | Covered | Covered |

| Accidental Damage to Your Car | Not Covered | Not Covered | Covered |

| Natural Disasters | Not Covered | Not Covered | Usually Covered |

What Affects Car Insurance Premiums in 2026

Understanding the factors that influence your car insurance premium can help you make smarter decisions when choosing coverage. Let’s break down how these elements impact what you pay.

Vehicle Value and Type

Your car’s value plays a key role in determining your insurance premium. Insurers typically calculate premiums as 3%–4.5% of the car’s value. For example, if a Mitsubishi Lancer is valued at KSh 2.1 million, the premium at a 3.5% rate would be approximately KSh 74,880.75.

The make, model, and age of your vehicle also matter. High-performance or rare cars tend to have higher premiums because their parts and repairs are more expensive. For instance, insuring a 2007 Toyota Axios valued at KSh 800,000 might cost KSh 28,000, while a 2010 model valued at KSh 1,000,000 could cost KSh 35,000. Additionally, vehicles older than 15 years are often excluded by insurers, and older cars generally come with higher premiums due to increased risk.

Driver Profile and History

Your age, experience, and driving record significantly influence your premium. Younger, less-experienced drivers usually pay the highest rates, while drivers in their 30s to 50s often enjoy lower premiums thanks to their established driving history.

A clean claims record can also save you money. Drivers with no claims may qualify for a No Claims Discount (NCD), which can sharply reduce annual costs. On the other hand, frequent claims during a policy period can lead to higher premiums or even non-renewal of your policy. To preserve their NCD, many experienced drivers opt to pay for minor repairs out-of-pocket instead of filing claims.

Location and Vehicle Usage

Where you live and how you use your car also play a part in determining your premium. Living in high-crime areas or congested urban centers like Nairobi typically results in higher rates.

Your car’s purpose matters too. For example, third-party coverage starts at around KSh 7,574 for private vehicles, while Public Service Vehicles (PSVs) may cost about KSh 9,583. Commercial vehicle rates vary by tonnage, ranging from KSh 7,574 to KSh 35,000. If you don’t drive often, consider asking about pay-as-you-drive policies, which could help lower your costs.

Coverage Add-Ons and Extras

Optional add-ons can increase your premium but offer added peace of mind. These extras might include roadside assistance, courtesy car rental, windscreen coverage, or personal accident protection. While these features come at an additional cost, they can save you from unexpected expenses and reduce stress when something goes wrong. Be sure to compare the cost of these add-ons with the benefits they provide before making a decision.

Expected 2026 Car Insurance Costs by Coverage Type

The projected premiums for 2026 vary depending on the type of coverage you choose and your vehicle’s value.

Third-Party Only (TPO) continues to be the least expensive option, with annual costs ranging between KSh 5,000 and KSh 15,108, regardless of your vehicle’s worth. However, this coverage only protects against damages caused to other parties and does not cover your own vehicle.

Comprehensive coverage is priced as a percentage of your vehicle’s value, typically between 3% and 7.5%. Most insurers set a minimum premium of about KSh 37,500. For vehicles valued under KSh 1 million, rates are usually between 6% and 7.5%, while vehicles worth over KSh 5 million tend to have rates closer to 3%.

Third-Party, Fire, and Theft (TPFT) offers a middle-ground option, with premiums estimated at around 5% of your vehicle’s value, translating to annual costs of KSh 18,000 to KSh 35,000. All premiums are subject to additional statutory charges, including a 0.2% training levy, a 0.25% policyholder levy, and a KSh 40 stamp duty fee. The table below provides a summary of expected premium ranges based on vehicle value.

Premium Cost Comparison Table

| Vehicle Value (KSh) | Third-Party Only (TPO) | Third-Party, Fire, and Theft (TPFT) | Comprehensive Coverage |

|---|---|---|---|

| Under KSh 1M | KSh 5,000 – 15,108 | KSh 18,000 – 35,000 | KSh 37,500 – 70,000 |

| KSh 1M – 3M | KSh 5,000 – 15,108 | ~5% of vehicle value | KSh 45,000 – 100,000 |

| Over KSh 3M | KSh 5,000 – 15,108 | ~5% of vehicle value | KSh 87,500 – 175,000+ |

sbb-itb-e5ed0ed

Insurance Costs for Common Vehicle Types

When it comes to calculating insurance costs in 2026, the type of vehicle you drive plays a big role. Different vehicles come with varying market values and risk levels, which directly impact the insurance rates you’ll pay.

Sedans and Hatchbacks

For sedans and hatchbacks valued under KSh 1 million, comprehensive insurance rates typically range between 6% and 7.5% of the vehicle’s value. This means annual premiums usually fall between KSh 37,500 and KSh 70,000, making them relatively affordable due to their lower market value. If you opt for third-party only (TPO) coverage, premiums stay even lower, ranging from KSh 7,574 to KSh 15,108. However, larger vehicles in this category often have a slightly different pricing structure.

SUVs and Pickups

SUVs and pickups tend to have lower percentage rates for comprehensive insurance – around 3% to 3.5%. But because these vehicles are generally more expensive, the actual premiums are higher. For instance, an SUV valued between KSh 2.5 million and KSh 5 million might cost anywhere from KSh 87,500 to KSh 100,000 annually for comprehensive coverage.

Commercial pickups, on the other hand, have rates influenced by their tonnage. Third-party insurance for these vehicles ranges from KSh 7,574 to KSh 35,000. If the pickup is used for business purposes, additional covers like Passenger Legal Liability may be required, adding to the overall cost.

Hybrid and Electric Vehicles

Hybrid and electric vehicles in Kenya follow a similar value-based premium structure as traditional cars. Comprehensive coverage rates vary depending on the vehicle’s price. Lower-priced models might see rates closer to 7.5%, while higher-value vehicles are generally insured at rates around 3% to 3.5%. For example, a hybrid car valued at KSh 3 million could cost roughly KSh 90,000 to KSh 105,000 annually for comprehensive coverage.

Currently, Kenyan insurers don’t offer discounts specifically for green vehicles. However, advancements in underwriting technology could change this in the future. Globally, the gap in insurance costs between electric and gas-powered vehicles is shrinking. By 2026, electric cars are expected to be about 18% more expensive to insure than their gas-powered counterparts, down from a 23% difference in 2025.

How to Lower Your Car Insurance Costs in Kenya

Saving on car insurance while keeping reliable coverage is possible. Here are practical strategies tailored for the 2026 market that can help you cut costs without compromising protection.

Choose a Higher Deductible

Opting for a higher deductible – commonly referred to as the "excess" amount in Kenya – is a quick way to reduce your annual premium. Essentially, this means agreeing to pay more out-of-pocket if you need to file a claim. By taking on more of the initial repair costs, you lower the insurer’s risk, which translates to a reduced premium rate. However, it’s important to make sure you can comfortably cover this amount if an accident occurs. If you’re concerned about the financial burden, consider adding an Excess Protector to your policy. While this add-on slightly increases your overall cost, it can ease the financial strain during a claim.

Bundle Multiple Policies

Combining multiple policies under one insurer can lead to noticeable savings. For instance, companies like Britam offer discounts for insuring several vehicles under a single policy. If your household has more than one car, bundling them together often results in better rates compared to insuring each vehicle separately.

Ask About Green Vehicle Discounts

If you drive a hybrid or electric vehicle, check whether your insurer offers discounts for environmentally friendly cars. While such incentives are still emerging in Kenya, global trends show the cost difference between insuring electric and gas-powered vehicles is shrinking – from 23% in 2025 to a projected 18% in 2026. It’s worth asking your provider about any available green vehicle programs.

Keep a Clean Driving Record

A safe driving history is one of the most effective ways to lower your premiums over time. Kenya’s No Claims Discount (NCD) system rewards drivers who avoid accidents and claims with discounts of up to 60%, depending on how many years they’ve gone without filing a claim. Additionally, some insurers, like GA Insurance, offer behavior-based discounts. By maintaining safe driving habits, you could earn up to 10% off your annual renewal premium.

Compare Quotes from Different Insurers

Insurance premiums can vary widely between providers, even for identical coverage. Shopping around and comparing quotes from multiple insurers can help you find the best deal. Make sure to get a current vehicle valuation report, as your car’s market value directly affects your premium. Don’t be afraid to negotiate with agents or brokers – premium rates are often more flexible than they initially seem.

Key Takeaways

Understanding what influences your insurance premiums can help you pick the right coverage. Factors like your vehicle’s value and age play a big role. Comprehensive insurance rates usually fall between 3% and 7.5% of your car’s market value. However, if your car is older than 15 years, you’ll likely be limited to Third-Party Only coverage. Your driving history also matters – keeping a clean record can qualify you for a No Claims Discount.

As of 2026, Third-Party Only insurance costs range from KSh 5,000 to 15,000, while comprehensive policies typically start at KSh 20,000 and can exceed KSh 60,000, depending on your vehicle’s value. Commercial vehicles and PSVs (Public Service Vehicles) often come with higher premiums because they spend more time on the road, increasing their risk.

You can lower your insurance costs by maintaining a spotless driving record, choosing a higher deductible, and shopping around for quotes – prices can vary significantly for the same coverage. Adding security features like tracking devices and bundling multiple policies under the same insurer can also lead to noticeable savings. These tips highlight how essential it is to align your policy with your driving habits and needs.

FAQs

What are the best ways to lower car insurance costs in Kenya for 2026?

To keep your car insurance costs down in Kenya for 2026, start by getting an accurate market valuation for your vehicle. This ensures you’re not paying higher premiums based on an inflated value. Another smart strategy is to compare quotes from different insurers to find competitive rates and explore available discounts.

Pick a coverage level that matches your needs – whether it’s basic third-party, third-party with fire and theft, or comprehensive – and avoid paying extra for unnecessary add-ons. A clean driving record can also work in your favor. By following traffic laws and avoiding accidents, you position yourself as a low-risk driver, which insurers often reward with lower premiums. You might also save money by bundling your car insurance with other policies, like home or personal accident coverage, to qualify for multi-policy discounts.

These steps can help you manage your insurance costs while staying compliant with Kenya’s legal requirements for coverage.

What’s the difference between Third-Party Only, Third-Party Fire and Theft, and Comprehensive car insurance in Kenya?

In Kenya, Third-Party Only (TPO) insurance is the minimum legal requirement. It provides coverage for damages or injuries you cause to other people or their property. However, it offers no protection for your own vehicle, regardless of the situation.

Third-Party Fire and Theft (TPFT) builds on TPO by adding coverage for your car if it’s damaged by fire or stolen. That said, it still does not include protection for accidental damage to your own vehicle.

For the highest level of protection, there’s Comprehensive Insurance. This option includes everything in TPO and TPFT, and it also covers damage to your own car caused by accidents, vandalism, riots, or strikes. Many plans also offer extras like roadside assistance or a courtesy car. While it’s the priciest option, it provides the most complete coverage, offering added peace of mind.

How does the value of my car impact my insurance costs in Kenya?

The price you pay for car insurance in Kenya is closely tied to your vehicle’s market value. Insurers base premiums on the car’s resale price, as more expensive vehicles come with higher repair or replacement costs if you file a claim. For comprehensive coverage, the premium typically sits at 3.2% of the car’s value. For instance, if your car is valued at KES 1,000,000, your annual premium would be about KES 32,000 (roughly $230).

Your insurance premium isn’t static – it shifts as your car’s value changes. Depreciation, upgrades, or market trends can all impact this value. Generally, newer and pricier cars are more expensive to insure compared to older, less valuable ones, even if factors like your driving history or the car’s safety features remain constant. To stay prepared, base your insurance budget on your car’s current market value and anticipate potential adjustments in premiums over time.

Related Blog Posts

- Car insurance costs in Kenya

- Comprehensive car insurance in Kenya: What to know in 2025

- What’s the cost of comprehensive car insurance in Kenya?

- How to Get the Best Car Insurance Deal in Kenya