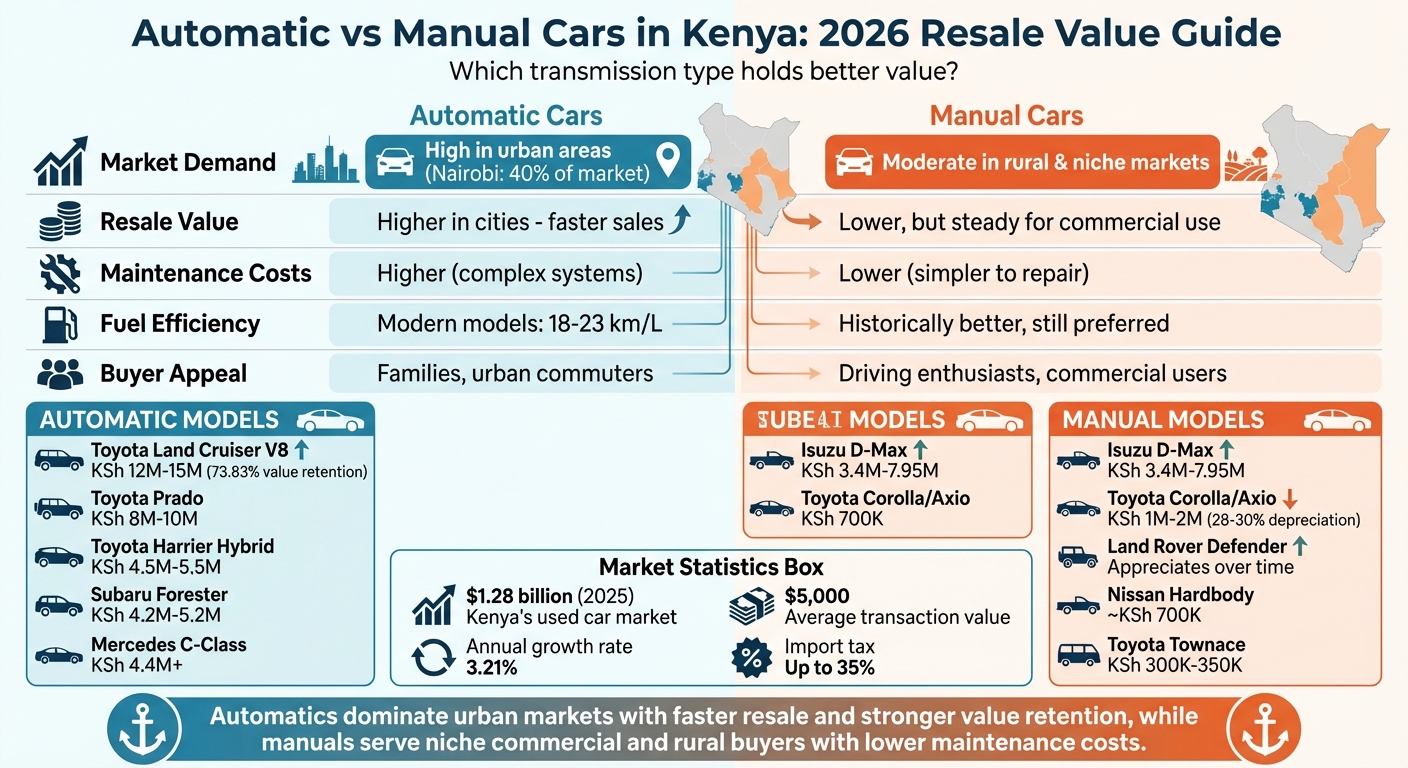

When deciding between automatic and manual cars in Kenya, resale value is a key factor. By 2026, automatics dominate urban markets due to their convenience in traffic-heavy areas like Nairobi, while manuals appeal to niche buyers such as commercial users and driving enthusiasts. Here’s what you need to know:

- Automatics: Higher demand in cities, faster resale, and stronger value retention, especially for popular models like the Toyota Harrier and Subaru Forester. Modern automatics also offer competitive fuel efficiency.

- Manuals: Preferred in rural areas and for commercial use due to lower maintenance costs and mechanical simplicity. Models like the Toyota Corolla and Isuzu D-Max remain popular but face a shrinking buyer pool.

Quick Comparison

| Criteria | Automatic Cars | Manual Cars |

|---|---|---|

| Market Demand | High in urban areas | Moderate in rural and niche markets |

| Resale Value | Higher in cities | Lower, but steady for commercial use |

| Maintenance Costs | Higher due to complex systems | Lower, simpler to repair |

| Fuel Efficiency | Modern automatics close the gap | Historically better, still preferred for control |

| Buyer Appeal | Families, urban commuters | Driving enthusiasts, commercial users |

Automatic vs Manual Cars Kenya 2026: Resale Value, Costs & Market Demand Comparison

Market Demand and Buyer Preferences in 2026

How Buyer Preferences Are Changing

Kenya’s car market is seeing a noticeable shift toward automatic transmissions, especially in urban areas like Nairobi. With traffic-heavy routes such as Thika Road creating relentless stop-and-go conditions, automatics have transitioned from being seen as luxury items to practical solutions. The convenience of two-pedal driving is becoming a necessity for many, as drivers look to avoid the constant strain of clutching and shifting in congested traffic.

Nairobi alone accounts for 40% of Kenya’s used car market, followed by Mombasa at 15%. These urban centers are driving the adoption of automatics. Households with multiple drivers find automatics particularly appealing since they eliminate the steep learning curve associated with manual transmissions. On the other hand, manuals still hold appeal for niche groups such as driving enthusiasts, "Subaru boys", and Safari rally fans who enjoy the hands-on control that manuals provide.

While automatics offer smoother acceleration through computer-controlled gear changes, manuals remain attractive for their lower upfront costs, better fuel efficiency, and simpler maintenance. This creates a divided market: automatics dominate among urban families and commuters, while manuals cater to budget-conscious buyers and commercial operators.

These shifting preferences are shaping the outlook for the 2026 car market.

2026 Market Outlook for Both Transmission Types

Looking ahead to 2026, automatics are expected to gain even more ground in Kenya’s car market. The used car market, valued at $1.28 billion in 2025, is projected to grow at an annual rate of 3.21%, reaching $1.50 billion by 2030. As global manufacturers continue to phase out manual models, automatics are becoming the go-to choice for households seeking versatile vehicles.

Resale trends are already reflecting this shift. Automatic models, especially popular SUVs like the Toyota Harrier and Mazda CX-5, are likely to retain stronger resale values in urban areas due to steady demand. Manuals, on the other hand, face a shrinking pool of buyers, appealing mainly to commercial users, rural customers, and car enthusiasts. For sellers, this means automatics are likely to sell faster and at higher prices in cities, while manual vehicles may require longer selling periods or price reductions to attract their smaller audience.

sbb-itb-e5ed0ed

Maintenance and Fuel Costs Comparison

Maintenance Costs: Automatic vs. Manual

When it comes to maintenance, manual transmissions tend to be easier on the wallet. Why? They have fewer moving parts compared to their automatic counterparts, making them simpler and cheaper to maintain. While manual systems are less expensive to repair, automatic transmissions hold their own by maintaining strong resale value – largely because buyers often prioritize the ease and convenience they offer. However, that convenience comes at a price. Automatic gearboxes rely on complex computer systems to handle gear shifts, which introduces more components that could require costly repairs down the line.

Brands like Toyota and Nissan help keep repair costs reasonable, thanks to abundant parts and a network of specialized service centers across Kenya. For example, a minor service for a Toyota Fielder – covering oil, air filter, and oil filter changes – typically costs around KSh 5,000. Routine oil changes range from KSh 3,000 to KSh 8,000, depending on the type of oil used. This affordability in maintenance pairs well with the fuel efficiency of many models, further boosting their resale value.

Fuel Efficiency and Resale Value

Fuel efficiency is another key factor influencing resale value, especially in Kenya’s market. Historically, manual cars had the edge in fuel economy because they allowed drivers to manage engine revolutions more precisely. But here’s the catch: modern automatics have largely closed this gap. Thanks to advanced sensors and computer systems, newer automatic transmissions optimize gear changes for improved fuel efficiency.

Take the 2018 Mazda Demio diesel, for instance – it achieves an impressive 22–23 km/L under real-world conditions and retains about 70% of its original value after five years. For high-mileage commercial drivers, this model can save up to KSh 120,000 annually on fuel compared to its petrol counterpart. Similarly, automatic models like the Toyota Vitz and Honda Fit deliver strong fuel performance, with averages of 18–22 km/L and 20 km/L, respectively. These advancements in fuel efficiency, combined with the convenience of automatics, have made them increasingly appealing, especially as fluctuating fuel prices remain a concern in Kenya. This improved efficiency not only lowers running costs but also bolsters their resale value over time.

Resale Performance of Popular Car Models

Top Automatic Models and Their Resale Value

In Kenya’s resale market, Toyota reigns supreme. The Toyota Land Cruiser is a standout, retaining an impressive 73.83% of its value after five years. By 2026, the Land Cruiser V8 is expected to sell for between KSh 12,000,000 and KSh 15,000,000. Its strong resale value is tied to its reputation as a status symbol among government officials, NGOs, and business executives.

Another top performer is the Toyota Prado, which is projected to fetch between KSh 8,000,000 and KSh 10,000,000 in 2026. This model is a favorite among corporate buyers and politicians, thanks to its 215 mm (approximately 8.5 inches) ground clearance and 7-seat capacity. The Prado’s 2.8L turbocharged diesel engine variant is particularly in demand, offering a smart mix of power and fuel efficiency.

For family-friendly SUVs, the Toyota Harrier hybrid (2.5L) is expected to maintain a price range of KSh 4,500,000 to KSh 5,500,000. Meanwhile, the Subaru Forester is projected to hold its value between KSh 4,200,000 and KSh 5,200,000. The Forester, a six-time winner of the ALG Residual Value Award, is celebrated for its strong value retention in its class. Even in the executive car segment, the Mercedes C-Class shines, with prices exceeding KSh 4,400,000. Known for its sharp chassis and luxurious interior, it continues to attract buyers who value both performance and sophistication.

While automatic models dominate urban markets, manual transmissions carve out a niche in more rugged and budget-conscious segments.

Top Manual Models and Their Resale Value

Manual cars hold their ground in Kenya’s commercial and budget markets. Take the Toyota Corolla, for instance, including its Axio variant. This compact car depreciates by just 28–30% over five years, one of the lowest rates in its category. It typically sells for between KSh 1,000,000 and KSh 2,000,000. Its ability to handle both city traffic and rough rural roads makes it a practical choice.

"Classic Defenders stand out among Kenya’s best-used cars for a unique reason: they often appreciate in value while the modern version depreciates like most new vehicles." – Peach Cars

The Isuzu D-Max manual is another strong contender, particularly in the commercial sector. Depending on the year, it is priced between KSh 3,400,000 and KSh 7,950,000. With a towing capacity of 3,500 kg (about 7,700 lbs) and lower initial costs, it’s a go-to option for entrepreneurs and contractors. However, the Toyota Hilux generally commands a higher resale value. For budget-conscious buyers, older manual models like the Toyota Townace (KSh 300,000–KSh 350,000) and Nissan Hardbody (around KSh 700,000) continue to offer reliable value in their respective segments.

Manual models thrive in rural areas and heavy-duty applications, where their mechanical simplicity and ease of repair outweigh the conveniences of automatics. The classic Land Rover Defender, equipped with 300TDI or TD5 manual engines, is a prime example. In Kenya, these vehicles not only retain their value but often appreciate over time, thanks to their rugged ladder-frame construction and straightforward mechanics.

Conclusion: Choosing the Right Transmission Type

Key Takeaways for Buyers and Sellers

Automatic transmissions lead the way in Kenya’s 2026 resale market. The preference for convenience has made automatics the go-to choice, especially in urban areas. For instance, navigating stop-and-go traffic on busy routes like Thika Road can make driving a manual car exhausting. If you’re planning to resell within 3–5 years, opting for an automatic hybrid like a Toyota Harrier or RAV4 could attract more buyers and fetch a higher price.

Manual cars, however, still have their place in specific markets. They’re favored by off-road enthusiasts and commercial operators who appreciate their lower maintenance costs and straightforward mechanics. But with manual vehicles becoming less common, their appeal is shrinking – especially in households with drivers of varying experience levels.

Keep detailed service records and address minor cosmetic issues to stand out in Kenya’s competitive 2026 market. Additionally, use the NTSA TIMS portal to confirm ownership and tax compliance. Buyers are increasingly cautious about avoiding legal complications. These factors reflect the broader trends shaping Kenya’s automotive landscape in the coming years.

What to Expect in Kenya’s Automotive Market

Kenya’s shifting market dynamics further underscore the advantages of modern automatic models. Rising import taxes, which can go as high as 35%, and the 2018 age limit on imports are pushing more buyers toward locally used vehicles. Online platforms and mobile payment systems are also making the market more transparent, favoring automatic cars that appeal to the widest range of buyers.

Fuel efficiency remains a key factor in resale value. With fluctuating fuel prices, hybrids are proving to hold their value better than traditional petrol-only cars. If your budget allows, consider an automatic hybrid – these vehicles are the "everyday champions" in Kenya right now. The average transaction value in the used car market is about $5,000, making mid-range automatics like the Subaru Forester (Ksh 4.2M–5.2M) and Nissan X-Trail (Ksh 3.8M–4.5M) attractive options that balance cost with strong resale potential.

Manual vs Automatic? Petrol vs Diesel? 🚐 The Best Toyota Hiace to Buy in Kenya Explained! 🇰🇪

FAQs

Do automatic cars have a better resale value than manual cars in Kenya’s urban areas?

In Kenya’s cities, automatic cars usually fetch a higher resale price than manual ones. Why? Urban buyers often value ease of driving, especially in the constant stop-and-go traffic of places like Nairobi and Mombasa. This preference drives up demand – and, as a result, resale prices – for automatics in city markets.

Meanwhile, manual cars find more favor in rural areas. Their durability and ability to handle rough roads make them a practical choice outside urban environments. Still, when it comes to resale value in cities, automatics tend to be the smarter investment.

Why are automatic cars becoming more popular in Kenya as we approach 2026?

Automatic cars are gaining traction in Kenya, particularly in bustling cities like Nairobi, where heavy traffic is a daily reality. These vehicles simplify the driving experience by removing the hassle of constant clutch use and gear shifting, making them a perfect fit for stop-and-go traffic conditions.

Advancements in automatic transmission technology have also narrowed the fuel efficiency gap between automatics and manual cars. On top of that, automatic vehicles often fetch better resale prices in urban markets, adding to their appeal for potential buyers. Their user-friendly nature, especially for first-time drivers, combined with the increasing availability of advanced models, continues to drive their popularity as we move closer to 2026.

Are manual cars still a good choice for resale in Kenya’s rural areas?

Manual cars continue to hold their ground as a reliable choice for resale in Kenya’s rural areas. They tend to be more affordable, both in terms of purchase price and maintenance costs, which makes them attractive to buyers who are mindful of their budgets. Plus, they handle rough, unpaved, and muddy roads – common in these regions – much better than many automatic vehicles.

Rural buyers also appreciate the fuel efficiency and dependability that manual transmissions often deliver. These qualities contribute to their strong resale value. While automatics may dominate the urban markets, manual cars remain a practical and favored option outside the bustling city centers.

Related Blog Posts

- Car prices in Nairobi 2025

- Manual vs Automatic Cars: What Kenyans Prefer and Why

- Why Car Prices in Kenya Are Changing in 2025

- New vs Used Cars in Kenya: What You’ll Pay in 2025