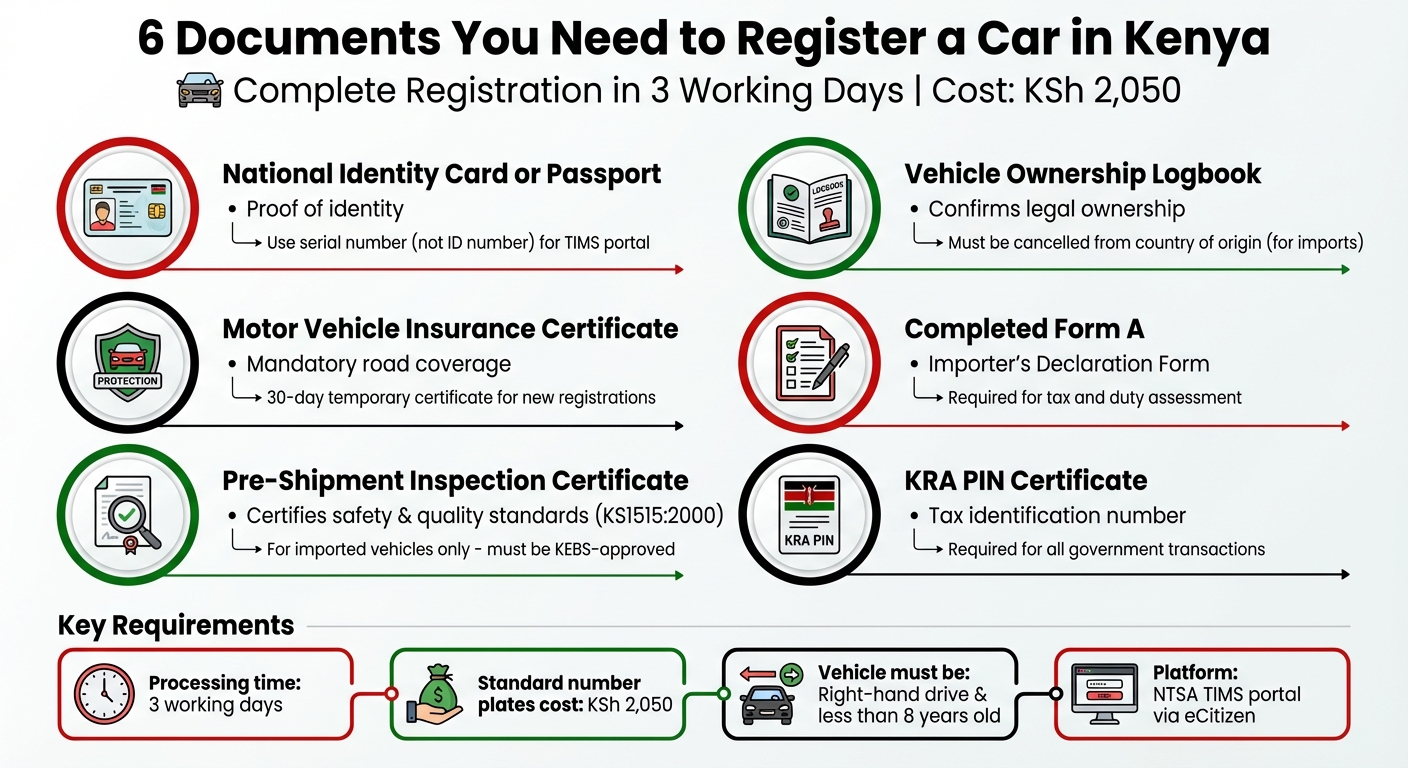

To register a car in Kenya, you need six key documents. Here’s the quick list:

- National Identity Card or Passport: Proof of your identity.

- Vehicle Ownership Logbook: Confirms legal ownership of the car.

- Motor Vehicle Insurance Certificate: Ensures the car is insured.

- Completed Form A: Required for registration.

- Pre-Shipment Inspection Certificate (for imports): Certifies the car meets safety and quality standards.

- KRA PIN Certificate: Verifies tax compliance.

The process is completed online through NTSA‘s TIMS portal on eCitizen. Both the buyer and seller must have active accounts. After submitting these documents, registration typically takes three working days, and the cost for standard number plates is KSh 2,050. For imported vehicles, ensure they are right-hand drive and less than eight years old.

Avoid common mistakes like using the wrong ID details, submitting incomplete documents, or failing to meet vehicle import regulations. Proper preparation saves time and helps you avoid delays.

6 Required Documents to Register a Car in Kenya

How to Apply For Motor Vehicle Registration Online in Kenya And Cost

1. National Identity Card or Passport

Your National ID or a valid passport is essential as proof of identity during the car registration process. The National Transport and Safety Authority (NTSA) uses this document to confirm you’re the legal owner of the vehicle and to prevent fraudulent activities. Without proper identification, the Registrar of Motor Vehicles cannot process your application.

When registering through the Transport Integrated Management System (TIMS) on the eCitizen portal, you’ll need to provide the serial number from your ID card, not the standard ID number. This serial number, found on your physical ID, serves as an extra layer of security to confirm your identity. Additionally, the system requires your mother’s maiden name and KRA PIN to complete the verification process. Be sure to have your physical ID card handy to input its serial number when creating your TIMS account.

The good news? You don’t need to visit a lawyer or commissioner of oaths to certify your ID. The entire verification process is handled digitally via the NTSA portal.

Before you begin, subscribe to NTSA’s SMS service by dialing _100_5_4_1# if you’re using Safaricom. This ensures you’ll receive the security codes and authorization passwords required during the process. When it’s time to pick up your physical number plates, make sure to bring your original National ID for final verification.

If the vehicle is being registered under a company name, you’ll need to provide the Certificate of Incorporation instead of a personal ID. Additionally, include a letter of authority for the person collecting the plates.

Once this step is complete, move on to reviewing your Vehicle Ownership Logbook to confirm legal ownership of the vehicle.

2. Vehicle Ownership Logbook

The Vehicle Ownership Logbook is your official proof of ownership and a key requirement in the registration process. Without it, the NTSA cannot confirm that you legally own the vehicle or proceed with registration.

For imported vehicles, you’ll need the original logbook from the country of origin. This document must be canceled by the foreign registration authority before the NTSA can process your application. The Kenya Revenue Authority explains:

Original Logbook from the country of importation that has been cancelled from the country of origin… will be required by National Transport and Safety Authority to give you an original Kenyan Log Book.

This cancellation ensures the vehicle has been de-registered in its country of origin, preventing issues like dual registration.

The validation process involves two key steps. First, a physical inspection at an NTSA-certified center confirms that your vehicle’s VIN, chassis, and engine numbers match those listed on the logbook. Second, you’ll need to upload a clear, color PDF of the original logbook via the eCitizen portal for digital verification. Once approved, the NTSA usually issues your Kenyan logbook within three working days. This digital step aligns with their streamlined registration system.

For locally purchased vehicles, it’s important to verify the logbook details online before finalizing your purchase. Use the NTSA portal to check the registration and chassis numbers. This service costs KSH 500 and helps protect you from buying a fraudulent vehicle. Additionally, clear any pending traffic fines or taxes beforehand, as these can delay the registration process.

Lastly, keep digital backups of your logbook and related documents. These copies will make ownership transfers and renewals much easier, saving you time at NTSA offices or Huduma Centers.

3. Motor Vehicle Insurance Certificate

The Motor Vehicle Insurance Certificate is an essential document required under the Insurance (Motor Vehicle Third Party Risks) Act. It serves as proof that your vehicle has the mandatory road coverage. Without this certificate, you cannot complete the vehicle registration process.

For new vehicle registrations or ownership transfers, a temporary insurance certificate is issued, valid for 30 days. According to the Insurance (Motor Vehicle Third Party Risks) (Certificate of Insurance) Rules:

A temporary certificate of insurance may be issued to a person for the purpose of enabling him to either – (a) obtain registration of, and a vehicle licence for, a vehicle not previously registered; or (b) obtain registration of change of ownership of a vehicle.

Only licensed Kenyan insurers can issue this certificate. They ensure that your vehicle complies with the Traffic Act’s inspection and licensing requirements. A duplicate of the certificate, marked "NOT FOR DISPLAY", is retained by the insurer as proof of coverage. The certificate must be issued by an authorized representative.

There are specific forms for different types of vehicles:

- Form 3: Private cars

- Form 2: Commercial vehicles

- Form 1: Public service vehicles

- Form 4: Motorcycles

Once issued, the certificate should be displayed vertically on the left side of your windshield for clear visibility. It’s important to replace expired certificates promptly to avoid complications with highway authorities. Additionally, you’ll receive a "third license" sticker, costing KSh 700, which is applied to your windshield to validate insurance and tax compliance. With your insurance certificate in place, you can proceed to complete Form A for registration.

4. Completed Form A

Once your identity and vehicle ownership are verified, the next important step is completing Form A, also known as the Importer’s Declaration Form. This document is essential for declaring your imported vehicle to the Kenya Revenue Authority (KRA) for tax and duty assessment. It captures key details such as the vehicle’s VIN, engine number, make, model, and CIF (Cost, Insurance, and Freight) value. These details play a crucial role in determining your tax obligations.

Form A serves as the foundation for calculating import duties and taxes. Here’s a breakdown of the applicable charges:

- Import Duty: 25% of the vehicle’s CIF value

- Value Added Tax (VAT): 16%

- Import Declaration Fee (IDF): 3.5%

- Railway Development Levy: 2%

- Excise Duty: Ranges from 20% (for vehicles with an engine capacity of 1,000cc–1,500cc) to 35% (for vehicles over 3,000cc). Electric vehicles benefit from a reduced excise rate of 10%.

To file Form A, you’ll need the assistance of a licensed customs clearing agent. They will submit the form through KRA’s SIMBA or iCMS portal using your KRA PIN (or Certificate of Incorporation for companies). You’ll also need to provide supporting documents, including the original commercial invoice, Bill of Lading, and Pre-shipment Inspection Certificate.

All duties must be paid, and the declaration process completed before customs will release your vehicle. Once you receive the KRA release note, you can proceed to the NTSA for your Kenyan logbook. Keep in mind that vehicle registration requires the car to be right-hand drive and less than eight years old.

sbb-itb-e5ed0ed

5. Pre-Shipment Inspection Certificate

Before exporting your vehicle to Kenya, it must pass a roadworthiness inspection and obtain a Pre-Shipment Inspection Certificate. This document, sometimes called a Certificate of Roadworthiness or Certificate of Conformity, confirms that the vehicle meets Kenya’s KS1515:2000 safety and environmental standards. Without this certification, customs may either reject your vehicle or impose hefty penalties. It’s a key step to ensure compliance with Kenyan import regulations.

The inspection must be conducted by a KEBS-appointed agent in the country of purchase. For vehicles sourced from Japan, Quality Inspection Services Japan (QISJ) is the main authorized agent. During the inspection, the agent checks critical details like the vehicle’s steering configuration and age. As John Mbati from Kenyans.co.ke explains:

"KEBS Pre-export Verification of Conformity to standards (PVOC Program) is a conformity assessment program applied to products in the respective exporting countries, to ensure their compliance with the applicable Kenyan Technical Regulations and Mandatory Standards."

Before shipping, double-check these details with your seller. Confirm the vehicle’s first registration date and steering configuration to avoid any surprises. The inspection also evaluates tire specifications, mechanical condition, and overall safety features to ensure the vehicle adheres to Kenyan road standards.

Keep the original certificate in a secure place. You’ll need to present it along with the original logbook and Bill of Lading when clearing customs and registering the vehicle with NTSA. Even with this certificate, the NTSA will conduct a final inspection upon the car’s arrival to verify the VIN, chassis, and engine numbers before issuing number plates.

6. KRA PIN Certificate

The KRA PIN (Personal Identification Number) is an essential document for registering any motor vehicle in Kenya. As mandated by the Traffic Act (Cap 403), vehicle registration and licensing cannot be completed without this unique identifier. Essentially, the PIN acts as your tax identification number for transactions with the government.

Once your identity and ownership details are verified, the PIN certificate becomes crucial for tax clearance. During vehicle registration or importation, the Kenya Revenue Authority (KRA) uses this PIN to calculate and collect the applicable taxes. Without a valid PIN, customs officials cannot process your vehicle clearance or finalize the forwarding process.

For individuals, the personal PIN is required, while companies, trusts, and schools must use a Non-Individual PIN. If you operate as a sole proprietor, remember that Kenyan law requires you to use your personal PIN for all transactions, including vehicle registration. Applying for a separate business PIN is not allowed in this case.

To obtain your PIN certificate, visit the iTax Portal online. Select your taxpayer type – "Individual" for personal registrations or "Non-Individual" for entities like companies. Fill out Sections A (basic details), B (tax obligations), and C (source of income). Most Kenyan residents receive their PIN certificate instantly via email after completing the process.

If you already have a PIN but misplaced the certificate, you can log into the iTax Portal to reprint it. Additionally, if you’re living abroad or currently have no income, it’s important to file NIL returns through iTax to keep your PIN active and compliant for future transactions, such as car registration. Make sure this document is ready before starting the vehicle clearance process.

Steps to Complete Registration

Got your documents ready? Here’s how you can complete your registration online. Start by logging in at serviceportal.ntsa.go.ke using your ID and password. If it’s your first time, complete the two-factor authentication and update your credentials as prompted.

Once logged in, head to your dashboard and click on "NTSA Service Portal (New)", followed by "Motor Vehicle Services". Select the type of application you need, upload all your documents as a single PDF file, fill in your vehicle details, and choose the logbook collection center nearest to you. Before submitting, take a moment to review all the details you’ve entered.

Next, check the declaration box and proceed to payment. You can pay using mobile money or eCitizen payment options, though note there’s a KSh50 convenience fee. The NTSA typically processes applications within 3 working days.

If you’re registering an imported vehicle, you’ll need to book a vehicle inspection through the eCitizen portal. Simply select your vehicle, choose the type of inspection required, make the payment, schedule an inspection slot, and print both the invoice and the inspection slip for your appointment.

Once your application is processed, NTSA will notify you to collect your physical logbook. For vehicle transfers, both the buyer and seller must log into their respective eCitizen accounts to accept the consent notification.

Common Mistakes and How to Avoid Them

Even when all documents seem to be in order, small mistakes can disrupt the registration process. For example, entering your ID number instead of the card’s serial number or failing to subscribe to NTSA SMS services (via _100_5_4_1# for prepaid or _200_5_4_1# for post-pay) can block you from receiving the security codes needed to log in. It’s also important to be aware of specific issues related to imported vehicles and ensure all documentation is accurate.

For imported vehicles, one common error is submitting a Certificate of Export (like those issued by Dubai Police) instead of the original logbook. The Kenya Revenue Authority (KRA) does not accept these certificates, and your application will be rejected. If the logbook is in a foreign language, you’ll need to provide an English translation authenticated by the relevant Embassy, High Commission, or Consulate in Kenya. Submitting untranslated documents will lead to delays.

Another critical factor is the vehicle’s age. Kenya only permits the importation of vehicles that are less than eight years old from the year of first registration. Bringing in an older vehicle will result in it being denied entry. Additionally, ensure the vehicle is Right-Hand Drive (RHD), as Left-Hand Drive vehicles are prohibited unless they are special-purpose vehicles like ambulances.

Here’s a quick summary of the most common errors and how to address them:

| Error | Outcome | Remedy |

|---|---|---|

| Using ID Number instead of Serial Number | TIMS portal registration fails | Use the Serial Number found on your physical ID card |

| Missing NTSA SMS subscription | Cannot receive security codes for login | Subscribe via _100_5_4_1# or _200_5_4_1# before starting |

| Submitting Export Certificate instead of Logbook | KRA/NTSA rejects ownership documents | Provide the authentic original logbook from the country of origin |

| Vehicle exceeds 8-year age limit | Vehicle denied entry into Kenya | Verify the year of first registration is within 8 years |

| Logbook in foreign language without certified English translation | Application delays | Get an English translation from the relevant Embassy or Consulate |

| Missing Pre-shipment Inspection | Customs clearance failure | Ensure a KEBS-appointed agent conducts the inspection |

Before buying any vehicle, it’s wise to conduct a motor vehicle search on the NTSA portal for KSh 550. This step ensures the engine and chassis numbers match the physical vehicle, helping you avoid fraud or mismatched records. Double-checking your documents and avoiding these common mistakes will help keep your registration process smooth and hassle-free.

Conclusion

To register a car in Kenya, you’ll need six key documents: your National Identity Card or Passport, the Vehicle Ownership Logbook, a Motor Vehicle Insurance Certificate, a completed Form A, a Pre-Shipment Inspection Certificate (for imported vehicles), and your KRA PIN Certificate. Each serves a specific purpose, from proving ownership to meeting tax and safety requirements.

"Over the years vehicle registration has been a cumbersome task, but in recent years things have changed and now it’s quite simple and can be done in a 2 to 5 days." – Bizna Reporter

If all your documents are in order, the process can now be completed in 2 to 5 days. This is a major improvement compared to the lengthy delays that used to frustrate vehicle owners. Proper preparation ensures you avoid unnecessary setbacks.

Before purchasing a vehicle, it’s wise to conduct a motor vehicle search on the NTSA portal for KSh 550. This helps verify that the engine and chassis numbers match the car you’re buying. It’s a small step that can save you from legal and logistical headaches later.

FAQs

What steps should I take to register a vehicle in Kenya if it’s over 8 years old?

If your vehicle is more than 8 years old, you’ll need to make sure it meets Kenya’s age and emissions standards before it can be registered. This requires obtaining an NTSA-approved inspection certificate. During the inspection, officials will check key details like the vehicle’s VIN, chassis number, engine number, and emissions compliance.

Start by scheduling an inspection at an NTSA-certified center. Once your vehicle passes, you’ll receive an inspection report. Attach this report to your registration application along with essential documents such as the logbook, proof of ID, KRA PIN, insurance, and the original purchase invoice. If your vehicle requires it, include a Certificate of Conformity to confirm it complies with age restrictions.

After completing the inspection and submitting all the necessary documents, you can move forward with the standard registration process.

What documents do I need to successfully register my car in Kenya?

To register your car in Kenya, you’ll need to gather a set of key documents to make the process as straightforward as possible. These include the original vehicle logbook, a clear PDF scan of the logbook, a valid government-issued ID (such as a National ID or passport), your KRA PIN certificate, the completed NTSA Form C, and a recent vehicle inspection or roadworthiness report. For imported vehicles, you’ll also need the original commercial invoice, bill of lading, and customs clearance documents like duty or VAT receipts and Form 63. Additionally, a current insurance certificate is required, and for used cars, you may need the original purchase invoice or sales agreement.

Before submitting your application, make sure all documents are clear and legible, translated into English if needed, and that the names match consistently across all paperwork. Verify that your insurance and inspection certificates are current, and keep both physical and digital copies of all documents. Sticking to this checklist will help you meet NTSA requirements and avoid unnecessary delays in the registration process.

What should I do if I don’t have a Pre-Shipment Inspection Certificate?

If you don’t have your Pre-Shipment Inspection Certificate, you could face delays or complications when trying to register your car in Kenya. This certificate is crucial because it verifies that your vehicle meets the necessary standards before being imported. Without it, you might be required to go through extra inspections, pay penalties, or even risk your car not being approved for registration.

To address this issue, reach out to the inspection authority or agency responsible for issuing the certificate. They can advise you on how to get a replacement or, if possible, provide alternative documentation. Taking quick action can help you avoid further setbacks and make the registration process much smoother.

Related Blog Posts

- Car ownership transfer in Kenya: common pitfalls to avoid

- Car import duties in Kenya: Full guide to KRA fees and clearance

- How to transfer car ownership in Kenya: NTSA & eCitizen steps

- 8 Things You Need to Know Before Importing a Car into Kenya