When it comes to car insurance in Kenya, the right plan can save you money and provide peace of mind. Here’s what you need to know:

- Legal Requirement: All vehicles must have at least Third-Party Only (TPO) coverage to comply with Kenyan law.

- Types of Coverage:

- TPO: Covers third-party damages but not your car (cost: KES 4,500–7,500/year).

- Third Party, Fire, and Theft (TPFT): Adds protection for theft and fire.

- Comprehensive: Covers your car against accidents, natural disasters, and more (3–4.5% of car value).

- Key Terms:

- Excess: Amount you pay upfront in a claim; can be reduced with add-ons like Excess Protector.

- Sum Insured: Your car’s insured value – ensure it’s accurate to avoid reduced payouts.

- Geographical Limits: Coverage is usually limited to Kenya unless you have a COMESA Yellow Card.

- Costs: Comprehensive insurance premiums are based on your car’s value (e.g., 3.5–7% annually). Additional government levies apply.

- Tips to Save:

- Install anti-theft devices for discounts.

- Maintain a clean driving record to earn no-claims bonuses.

- Adjust your policy by increasing voluntary excess or removing unnecessary add-ons.

- Choosing an Insurer:

- Check the Insurance Regulatory Authority (IRA) for licensed providers and claims settlement stats.

- Look for insurers with a strong claims history and a wide network of approved garages.

- Filing Claims: Report incidents within 24 hours, obtain a police abstract, and wait for insurer approval before repairs.

To get the best deal, focus on balancing cost, coverage, and service quality. Regularly compare providers and review your policy to ensure it meets your needs.

Don’t Overpay for Car Insurance! How to Choose the Perfect Motor Policy in Kenya | #insuranceworldtv

Car Insurance Basics in Kenya

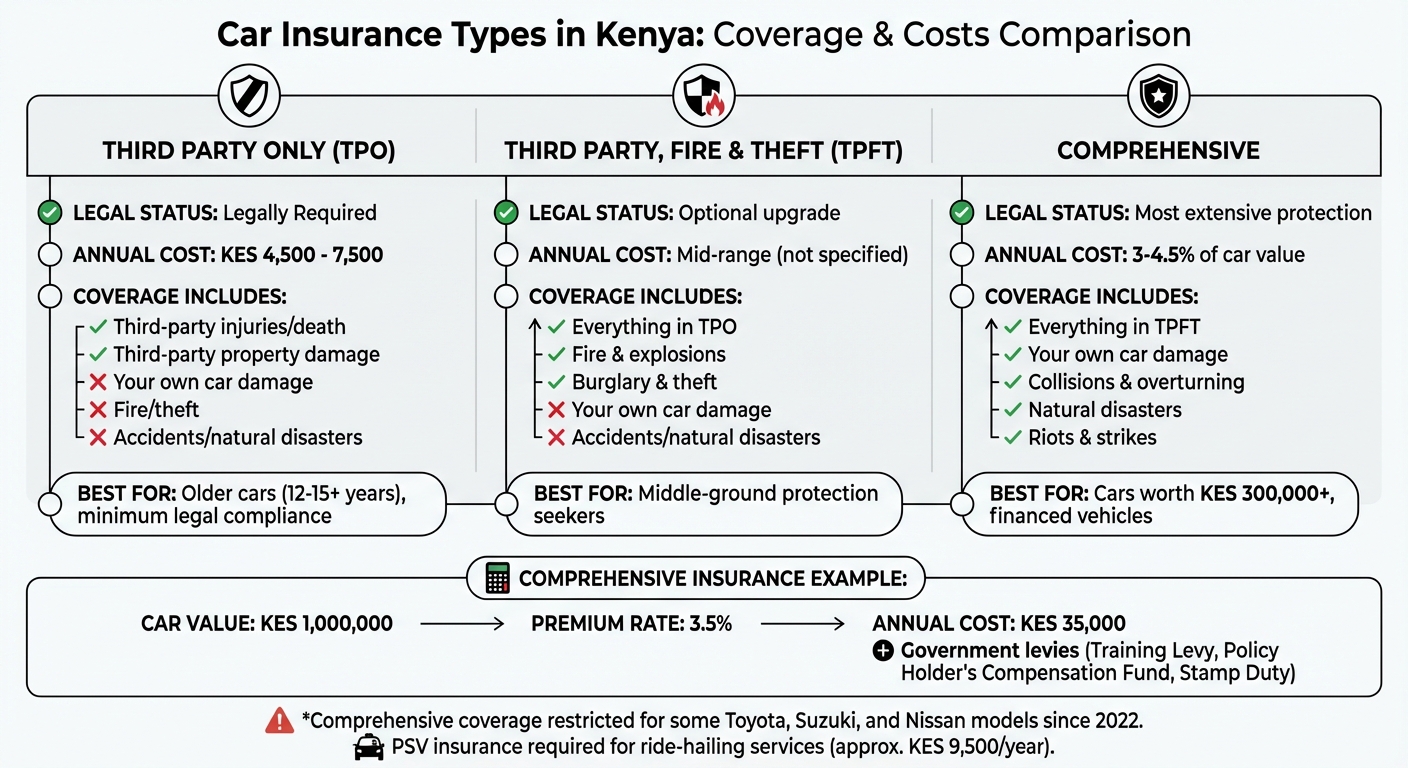

Car Insurance Types and Costs in Kenya Comparison Chart

Types of Car Insurance Coverage

In Kenya, car insurance comes in three main types, each offering varying levels of protection. The most basic option, Third Party Only (TPO), is legally required under the Insurance Act Cap 405. This policy covers injuries, death, or property damage caused to third parties. However, it doesn’t cover damage to your own car, theft, or fire. TPO typically costs between KES 4,500 and 7,500 annually.

The next level is Third Party, Fire, and Theft (TPFT). This builds on TPO by including coverage for fire, explosions, burglary, and theft. It’s a good middle-ground option for those looking for more protection without going all the way to full coverage.

For the most extensive protection, there’s Comprehensive Cover. This policy includes everything in TPFT and adds coverage for accidental damage to your own car. It also protects against collisions, overturning, natural disasters like floods, and even damage caused by riots or strikes. The annual premium for comprehensive insurance is typically 3–4.5% of your car’s market value. However, in 2022, insurers like APA Insurance and GA Insurance introduced restrictions on comprehensive coverage for some Toyota, Suzuki, and Nissan models.

Understanding these types of coverage is a vital first step before diving into the finer details of insurance policies.

Policy Terms You Need to Know

Once you’ve chosen the type of coverage that suits your needs, it’s equally important to understand key policy terms. This knowledge will help you manage risks and avoid unexpected costs when filing a claim.

- Excess: This is the amount you’re required to pay upfront when making a claim. To avoid paying this out of pocket, you can opt for an Excess Protector add-on. Other useful add-ons include Political Violence and Terrorism (PVT) cover, windscreen coverage (which usually costs KES 30,000–50,000 annually), roadside assistance, and courtesy car coverage.

- Sum Insured: This refers to your car’s insured value. Be cautious of under-insuring your vehicle, as it could result in reduced payouts during claims.

- Geographical Limits: Most policies only cover incidents within Kenya. If you plan to drive outside the country, you’ll need a COMESA Yellow Card to ensure third-party coverage in participating member states.

It’s also important to note what’s not covered. Policies generally exclude mechanical or electrical failures, normal wear and tear (like tire damage), incidents involving drunk driving, and accidents occurring in restricted areas. Knowing these exclusions can save you from unpleasant surprises later.

Determining Your Insurance Needs and Budget

Choosing Coverage Based on Your Vehicle and How You Use It

When deciding on insurance coverage, consider your car’s value, age, and how you use it. For vehicles worth more than KES 300,000 (about $2,325) and relatively new, comprehensive insurance is usually the best option. On the other hand, older cars – typically over 12 to 15 years – are generally limited to Third Party Only (TPO) coverage. Some insurers have even set a minimum car value of KES 750,000 for comprehensive plans .

How you use your vehicle also affects your coverage needs. Cars used strictly for personal errands tend to have lower premiums. If you drive for ride-hailing services like Uber, Bolt, or Little Cab, you’ll need specialized Public Service Vehicle (PSV) insurance. This type of coverage includes Passenger Legal Liability (PLL) for at least four passengers and typically costs about KES 9,500 annually for TPO coverage. For commercial vehicles, premiums are based on tonnage – for example, insuring a 30-ton truck starts at around KES 25,000 per year.

If your car is financed through a bank loan or microfinance institution, comprehensive insurance is usually mandatory. This ensures the lender’s investment is protected until the loan is fully repaid.

Understanding these coverage options is essential before diving into the details of how premiums are calculated.

How Insurance Costs Work in Kenya

Once you’ve identified the type of coverage you need, the next step is determining your premium. For comprehensive insurance, premiums are calculated as a percentage of your car’s current market value, typically ranging between 3.5% and 7%. For example, insuring a 2010 Toyota Axio valued at KES 1,000,000 would cost approximately KES 35,000 per year. Meanwhile, a 2012 Subaru Legacy worth KES 1,500,000 could have annual premiums between KES 56,250 and KES 67,000. Negotiating with your broker may help you secure a better rate.

In addition to the base premium, you’ll also need to pay mandatory government levies like the Training Levy, Policy Holder’s Compensation Fund, and Stamp Duty. These fees increase the overall cost. For instance, insuring a Mitsubishi Lancer valued at KES 2,100,000 with a 3.5% premium rate might cost around KES 74,880.75 annually. If the rate rises to 4.5%, the total could jump to approximately KES 95,975.25.

To make payments more manageable, many insurers offer flexible options such as premium financing or installment plans, allowing you to spread the cost over the year.

How to Compare Insurance Providers and Policies

Finding Reliable Insurance Companies

Start by confirming that the insurer you’re considering is licensed by the Insurance Regulatory Authority (IRA) of Kenya. The IRA website offers a comprehensive list of licensed insurers and brokers, along with claims settlement statistics. These stats reveal which companies consistently pay out claims, helping you avoid those in financial trouble, like the recent cases involving Invesco and Xplico.

Some of the major players in Kenya’s insurance market include GA Insurance, Britam, Madison, and Directline. It’s also worth checking the insurer’s network of authorized garages and suppliers. A broader network often indicates timely vendor payments, which means quicker repairs for your vehicle. To gauge customer service quality, try reaching out directly. As Boniface Njoroge, Director of Bowman Insurance Agency, puts it:

A good product with poor customer service is just as frustrating to clients.

Once you’ve identified trustworthy companies, the next step is to dive into the details of their policies.

What to Compare When Looking at Different Policies

After narrowing down reliable insurers, it’s time to compare their policies. Don’t just focus on the premium cost. Look at the excess amount – this is what you’ll pay out-of-pocket when filing a claim – and the scope of coverage. Check for additional perks like windscreen cover, towing services, and roadside assistance. It’s also wise to review the geographical limits of the policy. While most standard coverage applies within Kenya, some policies extend to other East African countries.

Be sure to examine the exclusions buried in the fine print. These can include restrictions on unauthorized drivers or specific natural disasters. Another important factor is the non-claim discount (NCD) structure. With several years of claim-free driving, you could earn discounts of up to 60%. And, of course, ensure that the policy meets Kenya’s minimum statutory requirements.

Once you’ve compared the features, it’s time to request precise quotes.

How to Get Accurate Insurance Quotes

Getting accurate insurance quotes starts with gathering the right documents. Have your vehicle’s logbook details ready, including its make, model, year, and Vehicle Identification Number (VIN). You’ll also need information about the drivers and where the car is typically parked. A professional vehicle valuation is essential, as premiums are calculated based on your car’s current market value.

You can request quotes through several channels. Visit insurer offices in person or use online calculators available on the websites of providers like Britam and GA Insurance. When filling out the forms, be as accurate as possible about your car’s security features and driving history. Insurers often verify this information through police records and previous insurance providers. As Abraham Chami, Direct Business Marketing Manager at GA Insurance, advises:

Being a good driver will save you from paying claim excess which is mandatory and protects you from deaths and injuries to yourself and other road users.

sbb-itb-e5ed0ed

Ways to Lower Your Premium While Keeping Good Coverage

Reducing Risk to Lower Your Premium

Adding security features to your car can help you save on insurance. For example, installing a tracking device or anti-theft system not only protects your vehicle but can also earn you a discount on your premium from certain insurers. Plus, these features might lower the amount you’d need to pay if your car gets stolen.

Maintaining a clean driving record is another effective way to reduce your premium. Many insurers offer no-claims bonuses, which reward you with lower premiums for each year you avoid filing a claim. Even minor accidents can affect this bonus, so it might make sense to pay for small repairs yourself if the cost is less than your excess amount. These steps can set you up for long-term savings.

Adjusting Your Policy to Save Money

One way to cut costs is by increasing your voluntary excess – the amount you agree to pay out of pocket when making a claim. This can lower your premium by as much as 40%, especially if you’re a confident driver with a good track record. However, make sure the excess is an amount you can comfortably afford.

If you have an older vehicle, consider switching to Third Party, Fire, and Theft (TPFT) or Third Party Only (TPO) coverage. These options are often cheaper and still provide adequate protection. Additionally, review any extras on your policy, such as roadside assistance or political violence cover. Removing unnecessary add-ons can help trim your insurance costs without sacrificing essential coverage.

But policy tweaks aren’t the only way to save – take advantage of discounts whenever possible.

Discounts Available in Kenya

Many insurers reward safe driving with discounts. The no-claims bonus (NCB) is one of the most common, offering lower premiums for each year you go without filing a claim. Some companies also provide special rates for certain groups, such as parents, older drivers, or those with a long history of safe driving.

Bundling your insurance policies can also lead to loyalty discounts. If you work with an insurance broker, ask about exclusive offers they might have. Brokers often have access to deals that insurers don’t advertise directly. And if you’re driving less – perhaps because you’re working from home – mention this to your insurer. Reduced mileage can sometimes lead to lower premiums.

Understanding Your Policy and Filing Claims

What to Look for in Your Policy Documents

Taking the time to go through your policy documents can save you from surprises when filing a claim. Pay close attention to the exclusions section – this typically outlines situations like wear and tear, mechanical breakdowns, or damage caused by driving under the influence. In Kenya, the legal Blood Alcohol Content (BAC) limit is 0.035%, and exceeding it can lead to claim denial. Similarly, driving in restricted zones, such as airport no-go areas, is generally not covered.

Check your excess or deductible amount – this is the portion of costs you’ll need to pay out of pocket before your insurer steps in. Some insurers in Kenya offer an "Excess Protector" add-on for an extra premium, which can eliminate this cost. Also, confirm the coverage limits for items like windshields (often capped between KES 30,000 and KES 50,000) and radio cassettes to ensure these align with your replacement costs.

If you’ve made modifications to your vehicle, such as adding tinted windows, aftermarket bumpers, or upgrading the sound system, make sure these changes are disclosed in your policy. Failure to do so could invalidate your coverage and lead to claim rejection. Additionally, check whether your policy includes Political Violence and Terrorism (PVT) coverage. Damage from civil unrest is often excluded unless explicitly stated in comprehensive policies.

Once you’ve reviewed and understood your policy, you’ll be better prepared to navigate the claims process.

How to File a Claim in Kenya

Being familiar with your policy is crucial when it comes to filing a claim. Start by notifying your insurer within 24 hours of the incident. Even if you’re unsure about filing a claim, reporting promptly is essential, as delays are a common reason for claim denials. Many insurers now allow notifications through WhatsApp, making this step quicker and more convenient.

Next, obtain a police abstract from the nearest station. This document is mandatory and should include the abstract number, date, and an official stamp. While at the scene, take wide-angle photos of both vehicles, license plates, skid marks, and any relevant road signs – these serve as valuable evidence.

Before making any repairs, wait for approval from a loss assessor appointed by your insurer. Starting repairs without an official go-ahead or an authority letter could result in your claim being rejected. Depending on your insurer, you may be directed to a panel workshop that bills them directly, or you could opt for "cash in lieu" if you prefer using your own garage.

Be prepared to submit several documents, including the police abstract, a copy of your driver’s license, your vehicle logbook, your KRA PIN certificate, and an NTSA inspection report detailing the damage. Keep copies of everything for your records. If the repair costs exceed 60% of your vehicle’s insured value, the insurer may declare it a total loss and compensate you based on the vehicle’s market value. Under guidelines from the Insurance Regulatory Authority (IRA), insurers are required to settle approved claims within 90 days.

If your claim is denied, you have options. Start by escalating the issue internally with the claims manager. If that doesn’t resolve the problem, you can file a formal complaint with the Insurance Regulatory Authority at [email protected] or invoke the arbitration clause in your policy. A well-handled claims process ensures you get the most out of your insurance policy.

Conclusion

This guide has covered key strategies to help you protect your vehicle effectively. Let’s recap the main points.

To secure the best car insurance deal, compare providers, understand your policy thoroughly, and choose coverage that aligns with both your vehicle and budget. Make it a habit to review prices annually and check IRA claim settlement records for insights into insurers’ reliability and service quality. While cost is important, focus on insurers known for dependable claims processing and excellent customer support.

Be mindful of critical policy terms and exclusions. Opt for coverage that reflects your car’s current market value to avoid being underinsured. If you have a clean driving record, consider setting a higher deductible – it could reduce your premiums by as much as 40%. By balancing value, understanding your policy, and regularly comparing options, you can create a solid plan that safeguards both your vehicle and your finances.

As regulations and technology continue to evolve, staying up-to-date is essential. The steps outlined in this guide equip you to navigate Kenya’s ever-changing automotive insurance landscape. For ongoing updates on market trends, provider performance, and practical advice tailored to Kenyan car owners, AutoMag.co.ke is here to help. Whether you’re renewing your policy, exploring new coverage options, or staying informed about industry developments, AutoMag.co.ke remains your go-to resource for smart insurance decisions.

FAQs

What should I consider when choosing car insurance in Kenya?

When you’re picking car insurance in Kenya, the first step is to figure out the kind of coverage you need. Comprehensive coverage takes care of theft, accidents, fire, and natural disasters, while third-party insurance only covers damages to other people or their property. To avoid surprise expenses, choose a policy that aligns with your car’s value and your personal needs.

Next, take a close look at the insurer’s reputation and services. Go for companies known for a smooth claims process, a strong network of repair shops, and solid customer feedback. Insurers that offer easy-to-use online tools for getting quotes and managing your policy can save you time and hassle.

Lastly, don’t forget to compare costs and discounts. Your premium will depend on factors like your car’s age, its value, and your driving history. You can cut costs by shopping around for quotes, bundling policies, raising your deductible, or taking advantage of discounts for safe driving or insuring multiple vehicles. A bit of research can go a long way in finding a policy that balances affordability and quality.

What are the best ways to lower my car insurance costs without losing good coverage?

To cut down on car insurance costs while keeping solid coverage, start by getting an accurate estimate of your car’s value and shopping around for quotes from various insurers. Stick to the coverage you actually need, and think about bundling your car insurance with other policies – like home insurance – for potential savings. Another tip? Increase your deductible to lower your premium, but only if you’re comfortable covering that amount out-of-pocket if necessary.

Keeping a clean driving record and adding anti-theft devices to your car can also help you snag lower rates. Make it a habit to review your policy regularly to ensure it still fits your needs, and don’t miss out on discounts for safe driving or loyalty programs.

What are the steps to file a car insurance claim in Kenya?

Filing a car insurance claim in Kenya requires careful attention to a few key steps to make the process as smooth as possible. Start by prioritizing safety – check if anyone is injured, move to a secure location, and take steps to prevent further damage to the vehicle or surrounding area. Once everyone is safe, report the incident to the police immediately. A Police Abstract/Report is essential and will be required when filing your claim.

Next, inform your insurance company or agent as soon as you can. Share basic details such as the date, location of the accident, and any supporting evidence like photos or videos. It’s a good idea to gather all the required documents early. These typically include the police report, a completed claim form, a copy of the driver’s license, and a repair estimate from a garage approved by your insurer. Submit these documents to your insurance provider, who will confirm receipt and explain the next steps.

Your insurer may arrange for the vehicle to be assessed before making a decision on the claim. Once the claim is approved, they will either authorize repairs or provide a payout. Don’t forget to pay any required excess amount and stay in touch with your insurer to ensure the process moves along efficiently.

Related Blog Posts

- Where to buy certified used cars in Kenya

- Car insurance costs in Kenya

- Comprehensive car insurance in Kenya: What to know in 2025

- What’s the cost of comprehensive car insurance in Kenya?